American Factories Continue to Gain in New Machine Tools

The latest world survey shows consumption keeps growing as recovery from 2008 to 2010 slump levels off.

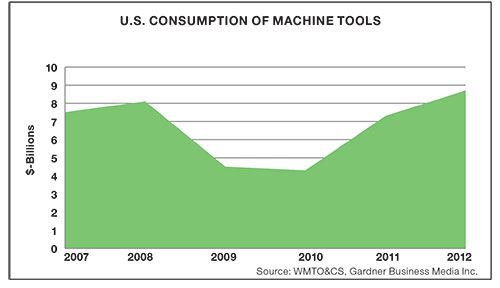

After the recession hit, metalworking plants in the United States cut back dramatically on upgrading their equipment. The volume of new installations dropped by more than 45 percent in a single year and continued declining into 2010.

The recovery that started two years ago has continued into 2012, according to the latest annual survey of machine tool consumption.

In fact, in a year in which most other manufacturing nations appear to have leveled off in installing improved equipment, the United States grew its new installations by a respectable 19 percent to $8.7 billion.

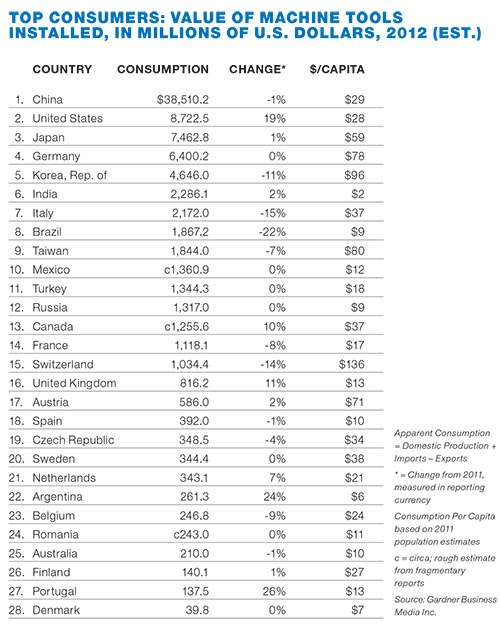

The figures come from the latest annual World Machine Tool Output & Consumption Survey, conducted by the research department of Gardner Business Media Inc., the publisher of this magazine. The study collects data from the 28 countries that produce virtually all the world’s machine tools and compares them in both local currencies and in U.S. dollars.

The 2012 rise in American consumption came from both a 7-percent gain in domestic output and nearly a 30-percent boost in imports. Consumption in any country is measured by taking its shipments, adding imports and subtracting exports. Unlike statistics on orders for future delivery, it represents the value of new machinery actually installed.

China, which has been the largest consumer by far for more than a decade, slowed its rate of installations last year, dropping 1 percent. Nevertheless, Chinese consumption remains almost unbelievably high at $38.5 billion, or more than the rest of the top ten consumers combined.

Among other top consumers, Japan grew by only 1 percent and Germany stayed even when measured in Euros, which equates to a drop of 7 percent when converted to U.S. dollars. Fifth-place South Korea declined 11 percent.

Another way of looking at any country’s installation of new factory equipment is to relate its consumption to its size. Thus, the survey looks at consumption per capita, which is detailed in the last column in the table on the following page. It’s simply the value of new installations divided by population, and many consider the statistic a measure of a country’s rate of industrialization.

Switzerland, with its relatively small population, has long been a leader in consumption per capita, and last year it again ranked first with $136 worth of new machinery per Swiss resident. The Republic of Korea, despite slipping in total equipment spending last year, still ranks second with nearly $96 spent per South Korean. Rounding out the top five in per-capita consumption are Taiwan, Germany and Austria. At the bottom of the list of countries that have domestic machine-tool-producing industries is India. Although it increased its consumption, with its huge population, India spent only $2 per person on new production equipment last year.

For many years, China, the world’s most populous country, also was at the bottom of the per-capita-consumption list. But recently it has been climbing upward and now places 11th among the 28 countries surveyed. In 2012, China spent $29 per capita on new machine tools, just ahead of the United States, at $28 per American.

In addition to consumption, the world machine tool survey also reports domestic production as well as trade. The total output comes to an estimated $93.2 billion for 2012. That’s a slight decline of 1 percent from the revised $94.2 billion that those same surveyed countries produced in 2011.

China tops the list of producers with $27.5 billion in output. The country’s domestic machine-tool factories have grown to fulfill local demand, which relied heavily on imports a decade ago. Japan is the world’s second-largest supplier with $18.3 billion in output, and Germany is third at $13.6 billion. Together, those top three producing countries account for 64 percent of the total surveyed world output.

American shipments in 2012 amounted to $5 billion, up from $4.7 billion, placing the United States seventh among machine-tool producers.

Regarding trade, patterns established in recent years persist. Japan remains the world’s biggest exporter of machine tools, with $11.6 billion shipped offshore. Next is Germany, with $10.4 billion, followed by Italy ($4.4 billion) and Taiwan ($4.2 billion).

On imports, the United States took in $5.8 billion in machine tools last year, an increase of 29 percent over the previous year. America’s imports amount to two-thirds of its consumption. In importing, the U.S. is second only to China, which acquired $13.7 billion from overseas last year.

Read Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.png;maxWidth=300;quality=90)