Best Practices of Top U.S. Shops

Results from our fifth annual Top Shops benchmarking survey reveal operational metrics, strategies and tools common to leading machine shops here in the States.

This year marks the fifth edition of our annual Top Shops benchmarking survey, which enables participants to compare their machining and business metrics and strategies with leading U.S. shops. Since 2011, approximately 1,700 shop owners or managers have participated in the survey, with 277 taking part in this year’s edition. Those participants received three reports that evaluated survey responses based on type of shop (job shop, contract shop or captive operation), number of parts produced in 2014 and number of employees in 2014.

This article highlights key findings from this year’s survey, which is based on shops’ 2014 performance. The survey is divided into four main categories: machining equipment, shopfloor practices, business strategies and human resources. Here, I analyze key data and interesting findings in these areas, comparing responses from the Top Shops benchmarking group to other shops that participated in the survey. The benchmarking group represents the top 20 percent of shops as determined by totaling the points assigned to certain business- and technology-related survey questions.

When citing numeric survey responses in this article, you’ll see that I primarily use the median value instead of the average. That’s because unlike an average, the median is not adversely influenced by overly high or low values (although data scrubbing is performed to remove obvious low or high outliers in each data set). Responses for all 41 survey questions are available in this free Executive Summary.

Participant Breakdown

Each year that we’ve offered this survey, the percentages of shop types have been similar. This year, 46 percent are job shops (independent shops that typically perform short-run and other non-repeating work), 38 percent are contract shops (independent shops that primarily have contracts for repeating part numbers), and 16 percent are captive shops that are part of a larger manufacturing company. The top industries served by this year’s Top Shops were aerospace (46 percent), machinery/equipment manufacturing (44 percent), and medical and military (both at 29 percent). Other leading markets for Top Shops include automotive, oil/gas, and hydraulic/mechanical component manufacturing.

Here is how these Top Shops compare to the others that participated in the survey in the four survey categories:

Machining Technology: Increased Use of Turn-Mills

For the most part, there isn’t that big of a difference in the type of equipment used by Top Shops and other shops. However, a much higher percentage of Top Shops use turn-mill multitasking machines at nearly 54 percent compared to 27 percent for other shops. These machines offer the chance to produce parts complete to minimize work in process (WIP), setups and the number of times a part is touched during production.

Top Shops have historically been more apt to use HMCs than other shops. This year, those percentages are 50 and 42 percent, respectively. HMCs are pricier than VMCs, but horizontals with dual-pallet design enable parts to be set up on one pallet, possibly on a tombstone, while machining is being performed on the other pallet, maximizing spindle uptime. They also lend themselves to pallet pool setups such as flexible manufacturing systems (FMS), which enable long stretches of unattended operation. This year, nearly 12 percent of Top Shops have FMS systems compared to only 6 percent of other shops.

The Top Shops also tend to use more advanced machining strategies. One example is highlighted in Table 1, which shows that a higher percentage of those shops are using four- and five-axis machining, either for full contouring or positioning operations. Although contouring operations tend to be more exotic than positioning, there is tremendous value in rotating and locking a part into an angled position and essentially performing a three-axis operation with the part oriented in that way. In many cases, this provides access to as many as five sides of a part to minimize setups and help ensure feature-to-feature accuracy. The best shops are also able to recognize that even relatively “simple” prismatic parts can oftentimes be prime candidates for four- and five-axis positioning operations.

Although just more than one-third of all surveyed shops perform hard milling, a greater number of Top Shops perform hard turning (48 compared to 35 percent). Hard turning can minimize or in some cases eliminate secondary grinding operations. A higher percentage of Top Shops perform high-speed machining (HSM), too, at 57 compared to 45 percent. HSM enables them to maximize material removal rates by taking lighter, faster cuts versus slower hogging operations. That said, an effective HSM process requires a number of elements to work in concert with each other, including the machine, the machine’s CNC (having sufficient look-ahead capabilities), tooling, fixturing and CAM software.

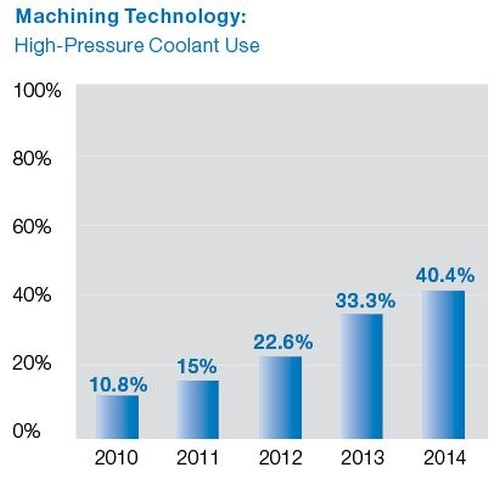

Many more Top Shops have machines with through-tool coolant delivery (81 compared to 49 percent) as well as high-pressure coolant systems. In fact, the percentage of leading shops using the latter has increased every year since we started the survey (see the Trends Spotlight sidebar on page 74). By directing the coolant stream more precisely and with the optimum amount of pressure, dramatically more heat can be removed from the cut zone. This degree of cooling also enables the cutting tool to remove greater amounts of metal, thus improving machine tool cycle times. High-pressure coolant also helps break up chips and remove them from the cutting area more efficiently, which means the cutting tool spends less time re-cutting chips.

The software used by Top Shops demonstrate the extent to which these shops want to have a firm handle on all aspects of the work that flows through their facility as well as the complexity of the work they perform. For instance, 67 percent of Top Shops use enterprise resource planning (ERP) software compared to only 45 percent of other shops. This shop management software enables more effective costing and estimating for more accurate predicting of how much it will truly cost a shop to produce a particular part. It also manages scheduling, which has to do with assigning the various operations of jobs to the shop’s various machines in an order that makes the most sense, and enables tracking each step in a part’s progress through the shop, so a part’s current status can be immediately known. These shops are also more apt to use toolpath simulation software (54 compared to 43 percent) due to the complexity of their parts and the more challenging machining operations they are more likely to perform on equipment such as five-axis machines and turn-mills.

Figure 1: Trends in High-Pressure Coolant Use

(all figure data taken from previous Top Shops surveys)

Shopfloor Practices: Integrating Unattended Processes

There are a few key shopfloor metrics that demonstrate the extent to which leading shops have established an effective overall approach to machining. One is spindle utilization. Top Shops report a median spindle utilization of 75 percent compared to 65 percent for other shops. Overall equipment effectiveness (OEE) is another telling metric. OEE is the product of the percentages of three equipment utilization indicators: machine availability, optimal rate that machines operate and quality yield. It indicates how close a given machining process is to achieving its full potential. A world-class OEE value is said to be 85 percent or higher. This year, Top Shops report a median OEE of 73 percent compared to 65 percent for other shops. While not all shops track this metric, more might start to, given the advancements in sensor and equipment monitoring technologies and application of concepts such as the Internet of Things and MTConnect (the Web-based manufacturing connectivity standard for gathering and sharing data from machine tools and other manufacturing equipment).

The most surprising finding from this year’s survey relates to setup time, defined as the time between the completion of the last good piece of the current run and the first good piece of the subsequent run. This year’s survey is the first in which the benchmarking group has a longer median setup time than the other shops (90 minutes compared to 68 minutes). It could be that the Top Shops are machining more complex components with higher profit margins that simply take longer to set up compared to more straightforward parts. That said, a higher percentage of Top Shops use quick-change workholding devices (56 compared to 38 percent) to enable fast setups and fixturing to enable multiple workpieces to be machined in a single cycle (81 compared to 54 percent).

As the chart on the previous page illustrates, the Top Shops’ use of machine-tending robots has increased in each year we’ve offered the survey, with nearly one-quarter of the 2015 Top Shops reporting they’ve integrated this type of automation into their processes compared to 11 percent in 2011. Given the recent advancements in collaborative robot technology, next year’s survey will ask about shops’ use of those devices, many of which have force-sensing capability to detect when contact has been made with a person and automatically stop arm motion.

These shops use other forms of automation to realize stretches of unattended machine operation, too. This includes the aforementioned FMS, as well as turning center bar feeds (44 compared to 34 percent) and bar pullers (37 compared to 21 percent). Bar pullers are particularly interesting, because they provide a low-cost means to enable turning centers to run unattended. They install in a machine’s turret station and mechanically grip the end of a bar with the turret’s Z-axis motion bringing the bar out of the spindle for the next operation.

Top Shops also tend to be more focused on lean manufacturing and have cultures of continuous improvement. Related to the latter, 62 percent of these shops have developed a formal continuous improvement program compared to 46 percent of other shops. Common lean manufacturing tools Top Shops are more apt to use include 5S workplace organization (60 compared to 34 percent), cellular manufacturing (33 compared to 18 percent), value stream mapping (33 compared to 18 percent) and kaizen events (25 compared to 15 percent). In addition, 62 percent of Top Shops have earned quality certifications, such as ISO, AS and NADCAP, compared to only 39 percent of other shops. Sometimes this is demanded by the customer, but in other cases it is a result of a shop’s own efforts to ensure quality, safety and efficiency.

Figure 2: Trends in Machine-Tending Robot Use

Business Strategies: Higher Capital Equipment Investment

There are a few metrics that highlight the extent to which this year’s Top Shops are more effective overall businesses compared to the other surveyed shops. A couple relate to sales produced by a shop’s two primary assets. The median sales per CNC machine for Top Shops is $277,000 compared to $123,900 for other shops (average values are $763,900 and $516,900, respectively). The median sales per employee is $185,000 for Top Shops and $112,300 for other shops (average values are $212,300 and $115,900, respectively).

Of course, the biggest indicator of business health is profit margin. Top Shops report a median profit margin of 13.5 percent compared to 8 percent for other shops. Top Shops are growing at a faster pace, too. The median growth rate from 2013 to 2014 for Top Shops was 17.5 percent compared to 7 percent for other shops.

The Top Shops also invest more in capital equipment as a percentage of gross sales at 9.5 percent compared to 3.5 percent. In 2014, the median amount Top Shops spent on capital equipment was $190,000 and the average was more than $745,000. For other shops, those values were approximately $48,000 and $449,000, respectively. Therefore, it isn’t surprising that the average age of machine tools used by Top Shops is only 7 years versus 9 years for other shops, as leading shops either add new equipment to increase capacity or replace older machines with fresh models.

Leading shops are also investing in their business in other ways. For example, 46 percent of Top Shops offer design for manufacturability (DFM) engineering services to customers torefine product designs to simplify machining and lower production costs compared to 27 percent of other shops. The key for leveraging this is to grow a relationship with the customer so shops can provide DFM input early in the product development cycle. Similarly, Top Shops are more likely to perform prototyping work for their customers. Nearly 20 percent of Top Shops have additive manufacturing equipment for rapid prototyping, compared to 13 percent of other shops.

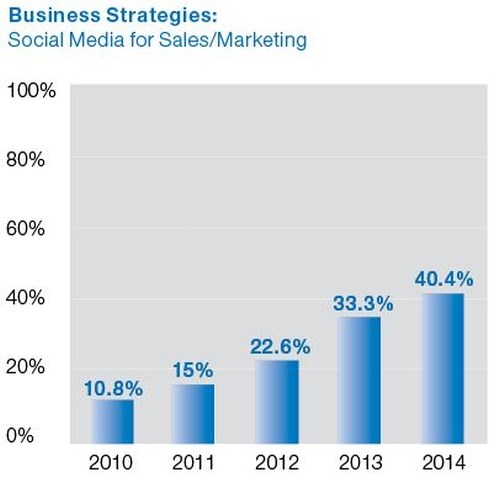

Every Top Shops benchmarking survey has asked about the use of social media (Facebook, Twitter, LinkedIn) as a sales/marketing tool. The benchmarking group has consistently been more apt to use social media than the other surveyed shops, and that percentage has increased by nearly four times since our first survey, from approximately 11 percent to more than 40 percent (see graph on page 74).

Figure 3: Trends in Social Media Use for Sales/Marketing

Human Resources: Using Benefits to Attract/Retain Employees

Each survey we’ve conducted has revealed that there isn’t much difference in the amount that Top Shops and other shops pay their employees. This year, the median hourly wage for CAM programmers is $25 and for setup personnel is $20 for both groups of companies, while Top Shops pay their machine operators $16 per hour compared to $17 per hour for the other shops.

However, as in past surveys, this year’s Top Shops cite other ways to reward and retain their good employees. For example, a higher percentage of Top Shops offer annual review and pay-raise programs (90 compared to 48 percent), paid medical benefits (75 compared to 43 percent) and bonus plans (71 compared to 30 percent).

This year’s survey also asked about the age and experience of shopfloor employees. The median age is essentially the same for Top Shops and other shops (39 and 40 years, respectively), but Top Shops are succeeding with personnel having less experience on the shop floor. The median number of years of experience for shopfloor employees at Top Shops is 10 years compared to 15 years for other shops. However, Top Shops are more willing to invest in growing the skills of their employees. More than half of the Top Shops provide education reimbursements for classes that are relevant to their employees’ career compared to only 30 percent of other shops. Plus, 45 percent of Top Shops have a formal training program compared to only 18 percent of other shops, and they’re also are more likely to provide supervisor development programs (35 compared to 17 percent) to cultivate a new crop of potential managers and leaders.

Figure 4: Trends in Annual Review/Pay-Raise Programs

Join Our Top Shops LinkedIn Group

Our goal in offering our annual Top Shops benchmarking survey is to cull and present the type of information that enables shops to see how they rank against others, determine what their deficiencies might possibly be and then decide what actions to take to become better overall machining businesses. As a complement to this survey, we’ve also set up an exclusive Top Shops LinkedIn group to enable you to share ideas, offer opinions and pose questions to other group members on a range of topics. I say “exclusive” because it is open only to decision-makers in machining facilities, including shop owners, managers, engineers, programmers and other senior personnel.

We’ve limited the group to only these people (as well our magazine’s editors, of course) because we believe this exclusivity is part of what makes this LinkedIn group different and helpful. The group now has nearly 1,800 members sharing ideas, offering opinions and posing questions on a range of topics. You’ll see that some of the threads have spurred multiple comments and interesting exchanges. Email me at dkorn@mmsonline.com if you’d like to join, and I’ll promptly send an invite your way. In addition, keep your eye out for next year’s online Top Shops benchmarking survey, which goes live in January and runs through February.

Related Content

Business Award Winner Gains Traction on Strategic Vision

KLH Industries joins the 2022 Top Shops Honors Program with a renewed sense of identity, a new leadership team and new tools for driving growth.

Read MoreIMTS Conferences - Monday

From innovation, quality and inspection to workforce development and company culture, Monday’s conference schedule has a lot to offer. Hannover Messe USA, the IMTS Conference, IMTS Job Shops and Women Make Manufacturing move all kick off today!

Read MoreBenchmarking: An Invaluable Business Tool

Modern Machine Shop’s Top Shops program shows shops their strengths and opportunities for improvement, and provides recognition for high-performing businesses.

Read MorePositioned to Prevail: Designing Processes Around People

Stecker Machine Company shows that getting the most value from employees means valuing your employees.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.jpg;width=70;height=70;mode=crop)