What’s Ahead For The North American Auto Industry

Here are highlights from a presentation by an auto-industry observer at Makino’s recent technology expo.

Kim Korth, the owner and president of automotive-industry consulting firm IRN, recently spoke at Makino’s 2009 Advanced Manufacturing and High-Precision Technology Expo.

The event took place at Makino’s Tech Center in Auburn Hills, Michigan, where attendance was encouragingly strong given the state of the economy. According to Makino, representatives of several hundred shops attended the event.

Ms. Korth’s presentation, “What’s Ahead for the North American Auto Industry,” addressed the macro economy, the auto industry and issues relevant to automotive part suppliers. The following points summarize some of the findings and insights she shared.

The unemployment situation is grim but not unprecedented.

The “grimness” could be seen in a chart that compared various state unemployment rates over the past decade. Today, Michigan’s unemployment rate is worse than Mississippi’s immediately after Hurricane Katrina. Still, the United States as a whole has seen worse unemployment before, and not even as long ago as the Depression. The 1973-75 recession had job losses worse than what we have seen so far.

The notion that consumer behavior will dramatically change may be wishful thinking.

During the 1991 recession, a survey of consumers asked what savings rate they planned to maintain when economic circumstances improved. The average response was 12 percent. But 3 years later, another survey showed that the actual average savings rate had reverted to just 2 percent.

In 2008, a similar survey again asked consumers what savings rate they intend to maintain. The average response this time was 14 percent. While a sustained 14-percent savings rate would, indeed, represent a dramatic reduction in consumer spending ... history suggests that the true savings rate will again revert to something much lower once the memory of the current recession fades.

Even in the U.S. auto industry, the decline in sales is not unprecedented—except to many who work in the industry.

Prior to our current period, the annual U.S. sales of light vehicles had not seen a dramatic decline since around 1990. This is a long, long time to go without a major drop. Many people in positions of responsibility within the automotive industry have never seen a drop like this during their automotive careers. Even so, declines in sales volume comparable to the current one have happened before: They happened twice during the 1970s.

In fact, Ms. Korth sees the automotive industry returning to the volatility of the 1970s, when total annual unit sales fluctuated within a wide margin of ±1.5 million units throughout the decade. The increased volatility means that suppliers with lower fixed costs are more likely to thrive.

Not everyone is going to be driving a small car.

The car-buying public’s interest in transitioning from large cars to small ones has been dramatically overstated. Even in the government’s “Cash for Clunkers” program, three of the top 10 vehicles purchased were trucks.

A survey recently asked the owners of various types of cars, “To meet your transportation needs, how practical would it be to replace your existing type of vehicle with one that is at least a size smaller?”

Among minivan drivers, only 10 percent said the downsizing would be practical. Among large pickup drivers, only 16 percent would downsize. For small pickups, the number was 20 percent. Meanwhile, 52 percent of small car drivers said they could downsize, along with 41 percent of midsized car drivers and 37 percent of small SUV drivers. Again, these figures represent the willingness of vehicle owners to decrease by just one size level.

In short, large vehicle owners still perceive a need for large vehicles and won’t go smaller. The only drivers that are truly likely to downsize their vehicles in significant numbers are the ones that are already driving small cars.

The current automotive business model is unsustainable.

That is, the business model is unsustainable that allows 3 to 5 years to proceed from concept to the start of production, followed by 4 to 7 years of producing the vehicle. In the electronics industry, each of these two phases lasts only about 18 months. By the time a new vehicle launches, the electronics in it are already three generations old. Following changes in other consumer industries, it seems practically inevitable that the automotive business model will adapt in the direction of more rapid product introductions and shorter product life cycles. Suppliers should anticipate this change.

In the automotive supplier community, things will get worse before they get better.

When suppliers were asked about their current financial situation this past spring,

● 24 percent were in violation of loan covenants

● Another 24 percent anticipated being in violation of load covenants by the end of 2009

● 54 percent had been approached for shorter payment terms by sub-tier suppliers

● 12 percent said they did not have access to working capital sufficient to support even a 10 percent increase in North American production.

Still, the supply base is not going away. Even after a 50-percent drop from 2007, North American light vehicle production remains enormous, with 10 million vehicles produced in 2009. Someone will make the parts for all of these cars.

Mold makers and other suppliers of tooling to automotive suppliers face both opportunities and challenges.

Ms. Korth sees the following changes in the auto industry as being particularly relevant to tooling suppliers:

● Consolidation will continue in the supply base, but we’ve likely seen the worst of it.

● Most of the suppliers that survived the recession are now stronger and more efficient.

● Suppliers are trying to do more with less. This creates opportunities for tooling companies to have more design influence earlier in the process—playing more of an advisory role.

● Commonality across platforms will increase the need for larger tool packages and common tools that can produce large volumes.

● For tooling companies in particular, the most significant challenges include sluggish demand likely to continue into 2010; problematic payment cycles; and the difficulty with finding and recruiting skilled personnel.

Domestic tooling suppliers are becoming more competitive relative to cheaper foreign sources.

Reasons for this include:

● The consumers of the tooling increasingly recognize the value of a domestic supply base, for reasons of both delivery time and quality control.

● Domestic manufacturing costs have gone down, in part because domestic tooling companies today save cost with greater use of automation and greater commitment to lean manufacturing.

● Tooling companies are increasing in sophistication and creating differentiation by specializing in niche technologies.

● Leading tool makers are investing in employee training to combat labor shortages and gaps in skills.

Generation Y is coming.

People born in the 1980s and '90s represent a population group comparable in size to the Baby Boomers. As more of the members of Generation Y enter adulthood and gain disposable income, this cohort will provide a promising source of demand for new cars.

Their expectations also promise to transform the car industry. This is a generation with very little experience in not having products accommodate them. This generation, for example, has rarely had to suffer a phone that was tethered by a cord, rarely had to watch a TV show at the actual broadcast time and (thanks to the Internet) rarely had to leave home to seek information. A likely response to this generation will be an auto industry that, somehow, adapts to offer greater choices in customizing cars and the car buying experience for the individual consumer.

Related Content

Tool and Die Shop Discovers New Opportunities With First CNC Machine

In a shop that stamps millions of parts per year, the arrival of a CNC machining center is opening new pathways for production and business.

Read MoreGrob Systems Inc. to Host Tech Event With Industry Partners

The 5-Axis Live technology event will highlight new machining strategies for optimizing the production of complex medical, aerospace and mold/die parts.

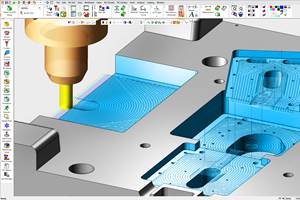

Read MoreCimatron's Updated CAD/CAM Software Streamlines Mold Design

Eastec 2023: Cimatron V16 includes a clean new user interface and increased automation for faster mold design, electrode creation and NC programming.

Read MoreHexagon Acquires TST Tooling Software Technology

Hexagon acquires TST Tooling Software Technology, a distributor of VISI, Hexagon’s CAD/CAM software for the mold and die sector, and PEPS CAM software.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)