MMS Blog

How I Made It: James Marzilli, Founder/President, Marzilli Machine

James Marzilli founded Marzilli Machine before the age of 30 on a dare from his wife Lee Anne, who now serves as CEO. As president, James has led the company to success by constantly refining his shop’s processes and seeking to learn.

Read MoreStuder's Automation, Entry-Level Solutions Take Center Stage

At its 2024 Music Motion Meeting, Studer AG showed off its entry-level line of grinding machines, as well as its newest universal loading system.

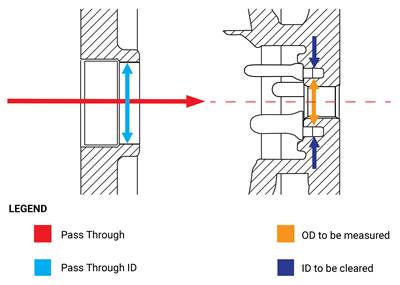

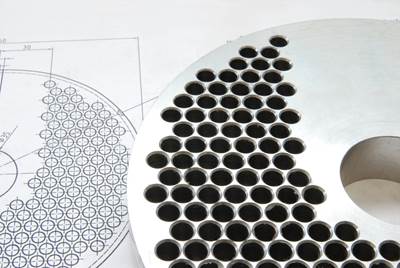

Read MoreTurning Fixed-Body Plug Gages Inside Out

Fixed-body mechanical plug gages provide fast, high-performance measurement for tight-tolerance holes.

Read More4 Reasons to Use Safety Commands

Safety commands help safeguard CNC applications from common programming or operation errors.

Read More3 Ways Artificial Intelligence Will Revolutionize Machine Shops

AI will become a tool to increase productivity in the same way that robotics has.

Read MoreBallbar Testing Benefits Low-Volume Manufacturing

Thanks to ballbar testing with a Renishaw QC20-W, the Autodesk Technology Centers now have more confidence in their machine tools.

Read MoreLeveraging Data to Drive Manufacturing Innovation

Global manufacturer Fictiv is rapidly expanding its use of data and artificial intelligence to help manufacturers wade through process variables and production strategies. With the release of a new AI platform for material selection, Fictive CEO Dave Evans talks about how the company is leveraging data to unlock creative problem solving for manufacturers.

Read MoreERP and Process Changes Increase Shop’s Revenue 64% YoY

Implementing ProShop has led to a massive process overhaul at Marzilli Machine. From 2020 to 2021, revenue increased 64% without capital investment.

Read MoreHexagon Adopts the Suite Life

Hexagon has rearranged its software portfolio into five process-based suites, which include software for every step in the workflow as well as a new program that connects everything, increasing automation and collaboration.

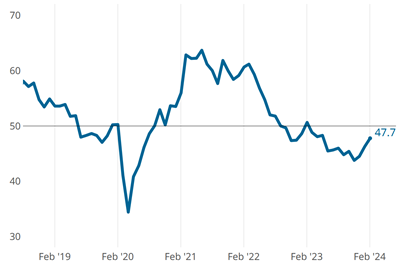

Read MoreMetalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

Read MoreHow to Successfully Adopt Five-Axis Machining

While there are many changes to adopt when moving to five-axis, they all compliment the overall goal of better parts through less operations.

Read MoreThe Importance of Modern Machine Shop

Moments of change shine a light on the priorities that have been consistent a long time, and on the worth we carry forward out of a rich past into the future.

Read More