MMS Blog

Top Shops 2024 Is Now Live

The Top Shops 2024 survey for the metalworking market is now live, alongside a new homepage collecting the stories of past Honorees.

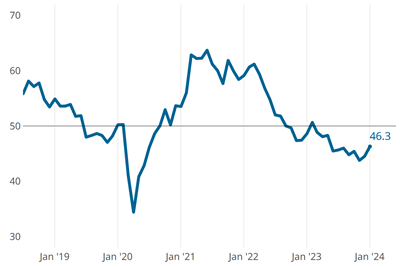

WatchMetalworking Activity Starts Year With Slowing Contraction

The GBI: Metalworking welcomed the new year with slowed contraction of components for the second month in a row.

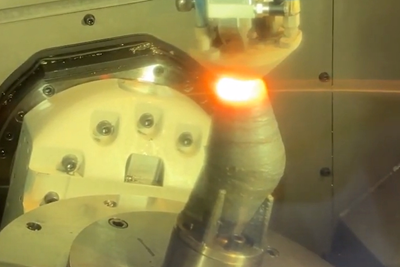

Read MoreAdditive/Subtractive Hybrid CNC Machine Tools Continue to Make Gains (Includes Video)

The hybrid machine tool is an idea that continues to advance. Two important developments of recent years expand the possibilities for this platform.

WatchThe Intersection of Work, Play, Technology and Independence

The February issue dives into digital technologies that not only streamline production, but make a tangible difference in people’s lives.

Read MoreHow I Made It: Kaci King, CEO of West Ohio Tool

For Kaci King, CEO of West Ohio Tool, a successful business starts with a successful company culture.

Read MoreTips for Mastering Stainless Steel Machining

When getting a grip on stainless steel, make sure you are very specific in how you talk about it and understand the pertinent information you need.

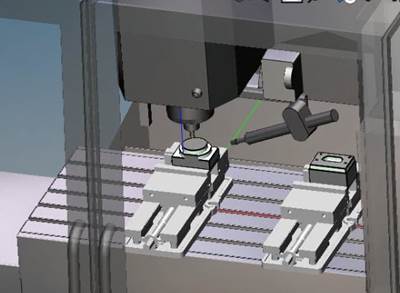

Read MoreHow Integrated CAD/CAM Transforms Inventions Into Products

The close connection between CAD and CAM is what links creative ideas to practical production for this unique custom manufacturer.

Read MoreThe Nuts and Bolts for Getting the Gaging Fixtures Right

Gage fixtures are the key to accurate and repeatable measurements, so make sure there is no play at its joints.

Read More6 Ways to Streamline the Setup Process

The primary goal of a setup reduction program must be to keep setup people working at the machine during the entire setup process.

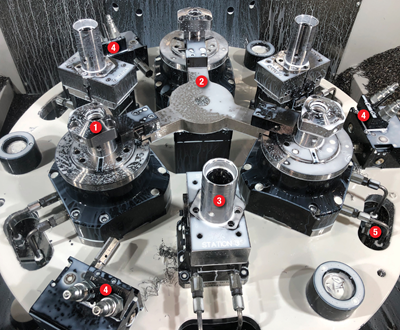

Read MoreMachining Vektek Hydraulic Swing Clamp Bodies Using Royal Products Collet Fixtures

A study in repeatable and flexible workholding by one OEM for another.

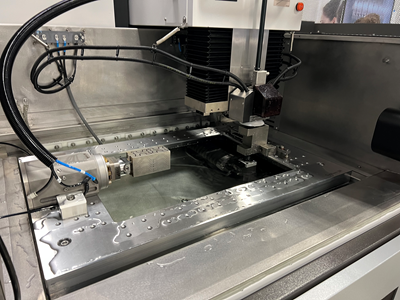

Read MoreHybrid Control Makes Lights-Out EDM More Accessible

This CNC enables EDMs to switch between G-code and an integrated CAM system to adapt to changing conditions and make lights-out manufacturing more attainable.

Read More

.png;maxWidth=300;quality=90)