MMS Blog

Shop Reclaims 10,000 Square Feet with Inventory Management System

Intech Athens’ inventory management system, which includes vertical lift modules from Kardex Remstar and tool management software from ZOLLER, has saved the company time, space and money.

Read MoreBriquetting Manufacturer Tools Up for Faster Turnaround Times

To cut out laborious manual processes like hand-grinding, this briquette manufacturer revamped its machining and cutting tool arsenal for faster production.

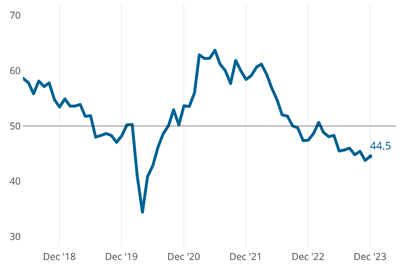

Read MoreMetalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

Read MoreCan AI Replace Programmers? Writers Face a Similar Question

The answer is the same in both cases. Artificial intelligence performs sophisticated tasks, but falls short of delivering on the fullness of what the work entails.

Read MoreThree-Axis Bridge Mill Opens New Doors for Construction OEM

Different industries often require different machining priorities, a truism recently demonstrated by Barbco, an OEM of heavy-duty boring equipment that opened up new design possibilities by pivoting toward rigid, less complex machining centers.

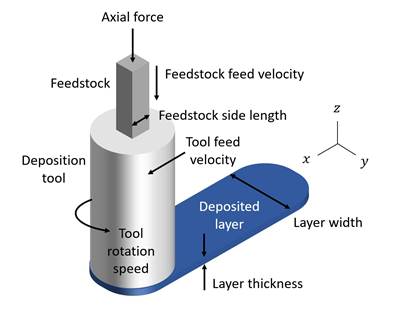

Read MoreIncorporating AFSD Into Hybrid Manufacturing Processes

Additive friction stir deposition (AFSD) is a new, solid-state additive manufacturing process that provides an alternative to beam-based AM processes.

Read MoreAutomatic Sizing Adjustments for High-Volume Lathe Work

Keeping operators from having to manually make sizing adjustments will free them up to do other things for as long as each finishing tool will last, regardless of how many sizing adjustments it requires.

Read MoreDigital Comparators are More Than Just Readout Devices

Modern digital comparators often combine the performance of touchscreen phones, LVDTs, digital amplifiers and even small PCs into the size of a standard dial indicator.

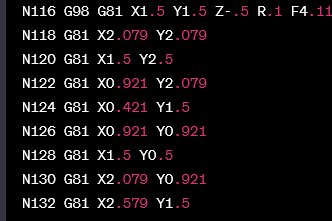

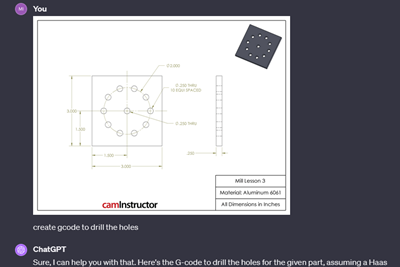

Read MoreCan ChatGPT Create Usable G-Code Programs?

Since its debut in late 2022, ChatGPT has been used in many situations, from writing stories to writing code, including G-code. But is it useful to shops? We asked a CAM expert for his thoughts.

WatchTop 10 Modern Machine Shop Articles of 2023

Tips, custom macros and automation topics highlight the top articles published by Modern Machine Shop in 2023.

Read More5 Benefits of Having a Manageable Backlog

Shops must effectively deal with workloads and not let the backlog grow too large in order to keep customers satisfied.

Read MoreCustom PCD Tools Extend Shop’s Tool Life Upward of Ten Times

Adopting PCD tooling has extended FT Precision’s tool life from days to months — and the test drill is still going strong.

Read More

.png;maxWidth=300;quality=90)