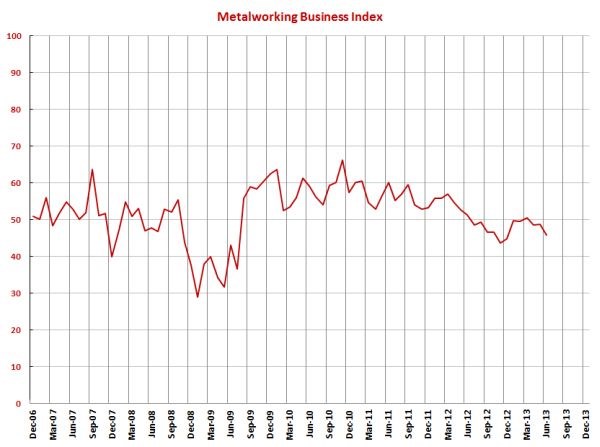

June MBI at 45.8 – Contraction Accelerates

With a reading of 45.8, Gardner’s metalworking business index showed that the metalworking industry contracted at a faster rate in June.

With a reading of 45.8, Gardner’s metalworking business index showed that the metalworking industry contracted at a faster rate in June. The industry contracted at its fastest rate in June since December 2012. The metalworking industry has contracted for 11 of the last 12 months.

Last month I mentioned that shops with fewer than 50 employees were contracting while shops with more than 50 employees were expanding. In June, only shops with more than 250 employees grew. Facilities with 50-249 employees moved from expansion to contraction while shops with fewer than 50 employees contracted faster.

New orders contracted for the third consecutive, contracting at the fastest rate since December 2012. Production contracted for the first time in 2013. Because production has remained stronger than new orders, backlogs contracted at their third fastest rate since March 2012. Employment grew for the seventh straight month, although the rate of growth has slowed. Exports continue to contract because of the relatively stronger dollar. Supplier deliveries shortened for the first time March 2010. The combination of all these subindices seems to indicate that there is some excess capacity in the metalworking industry. I think this explains why job shops and small shops are performing relatively worse than OEMs and large shops.

Material prices increased at a slightly faster rate while prices received increased at a slightly slower rate. Future business expectations declined slightly in June but have been fairly constant in 2013, which is about the level from the summer of 2012. Expectations are below the historical average.

In June, all nine regions contracted. The South Atlantic and West South Central regions contracted the slowest while the East South Central and Middle Atlantic contracted the fastest.

Future capital spending plans improved somewhat in June. They were at their fourth highest level since July 2012.

For more manufacturing economics news from Gardner Business media, visit our Economics Blog.

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)