If you can believe the economist, it is on its way to recovery. Machine tool shipments and imports have turned around since the 2009 recession low, and in recent months have steadily improved. After a dismal 2009 and poor start in 2010, quarterly shipments have started to increase, evidence that the industry has started to recover. This is encouraging, if it were not for the fact quarterly shipments fell to record lows and 2009 and 2010. It is like getting a few drops of wine to an empty wine glass—the glass is still less than half full.

Domestic machine tool shipments for the a year 2009 were at an all time low of $2.0 billion; with imports at an equally low level of $2.5 billion. The industry has recovered from recessions before (1992, 2003 and 2009) and there is reason to believe 2011 shipments will approach $3.0 billion. Does this mean the industry is out of the woods, and on the way to full recovery? A truer picture of the decline of the industry and where it is today can be obtained by using 1998 as a benchmark. It is also import to look at percentages rather than reported quarterly shipment and import dollars.

Shipments for the first quarter 2010, started the year at 33 percent of the 1998 level, when shipments averaged $1,175.00 million per month. Simple mathematics tells us shipments will have to increase 300 percent and exports 400 percent for the U.S. machine tool industry to regain its position as one of the top-five, leading world producers of machine tools. It is unlikely that this will happen, at least in the foreseeable future. Imports for the same period fell to a low of 43.6 percent. However, imports historically have exhibited a faster recovery than domestic shipments after a recession. What is more alarming is that units produced in 2010 were 16.1 percent of 1998 level of 50,000 per quarter.

The United States is currently in seventh place in world production of machine tools; behind Germany, Japan, China, Italy, Taiwan and South Korea. And its share of the global market has dropped from 10.5 percent in the year 2000 to 4.2 percent in 2009. This clearly has to be reversed if the United States is to regain its position as a leading world producer of machine tools along with Germany and Japan. The United States must substantially increase its production by gaining market share in the domestic market and increasing exports. This will not be easy as the industry has lost capacity due to mergers, buy-outs, consolidations and plant closings that have taken place over the years. In addition, except for a few large international builders in the United States such as Gleason, MAG-Giddings & Lewis and Haas Automation, the industry is composed of a number of small companies with limited capacity and resources to become established in world markets. To suit a major industrial nation, U.S. machine tool production should be in the order of $8.0 billion, with an output approaching 50,000 units per quarter—four times where the industry is today.

On the positive side, quarterly shipments are on the rise, and the industry is in a slow recovery. I have been asked, "Can the industry return to its former strength?" There are signs of encouragement. The ratio of exports to imports is improving, from 2.0/10 to 4.8/10. However, our negative trade balance needs to be reversed to a positive one, such as those of Germany (10/3), Taiwan (10/1.8) and Japan (10/1). And there is Haas Automation, who has proven that an American company can compete on a volume basis against the imports and the core market of CNC ladies and machining centers. In addition, the United States has been successful in the high-tech end of the market through innovation, automation and technology. But, with the exception of Haas Automation, all have but given up the large volume core sector of the market needed to provide the cash flow for R&D, and a profitable sustained operation.

The industry will need help from the current administration to maintain a sustainable level of shipments and increase its position in world markets. This needs to come in the form of tax relief, availability of credit, funding for R&D and trade agreements that assure unilateral and fair trade. There needs to be equal access, that is, equality on a level playing field. In addition, the industry needs relief from the mounting regulatory laws and policies that make U.S. companies non-competitive in world markets. And last, and perhaps most important, is the establishment of an environment favorable to the resurgence of manufacturing in the United States—the customer base of the machine tool industry. Other nations appear to have a better understanding of the value of manufacturing and of the importance of the machine tool industry that supports it.

American manufacturing and military requirements will continue to change and place further demands upon the machine tool industry for more productive and innovative machines. Where the technology and machine tools will come from is the question we need to ask.Our nation has become entirely too dependent upon foreign machine tool manufacturers. Imports currently account for 67 percent of total consumption, and in some segments of the market, from 79 percent to total dependency. We cannot afford to see the machine tool industry, one vital to our economy and war requirements, decline further. Is the machine tool industry well? Not yet.

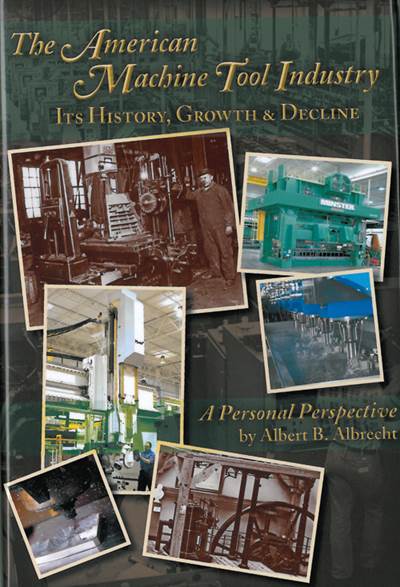

Albert B. Albrecht is an engineer, former vice president of Textron's Machine Tool Division in Cheshire, Connecticut, and retired co-owner of NATCO Inc., in Richmond Indiana. He is a graduate of Ohio Wesleyan University and has an engineering degree from Ohio State University. He is the recent author of a book, The American Machine Tool Industry: Its History, Growth & Decline. He can be reached at albertabrecht@frontier.com.

.png;maxWidth=300;quality=90)