Succession Planning: The Right Way To Value Your Family Business

Tax-free transfer strategy.

Do you own all, or part of, a closely-held business? Like it or not, some day you’ll have to value that business because stuff happens. This “stuff” includes things such as gifts; a sale of the family business to the kids; a death (requiring valuation for estate tax purposes); a divorce (where valuation becomes an expensive legal battle); or buying a business or selling your business to someone outside of the family. The wrong valuation can rob you and your family of hard-earned dollars. It can even cause your business to be sold to pay taxes.

Let’s say you want to value your business because the time has come to transfer your business to the kids. You want to slow down, the kids are ready to run the show and the estate tax monster will enjoy a big payday if you get hit by a bus.

These are all good reasons to value your business. Yet, you are torn because you don’t want to give up control. You are about to be delighted by how easy it is to transfer your business to the next generation, save a lot of money on taxes and still stay in control for as long as you live.

Let’s run through an outline of the five-step process of the best way to transfer your business to your children. I call it the “tax-free transfer strategy.”

Assume Joe owns 100 percent (it can be any percentage) of Success Co.

Step #1. Recapitalize Success Co. A “recapitalization” is a fancy name for turning your old voting common stock (Joe owned all 200 shares of Success Co.) into voting (say 100 shares) and nonvoting stock (say 10,000 shares).

Step #2. Have Success Co. valued. If you shoot for the right valuation (not high or low), competent business valuation experts always seem to come very close to the same valuation for a profitable business. Admittedly, nonprofitable businesses are a challenge to value. Joe’s business is profitable and was valued at 5.1 times pretax earnings. (Whether you operate as a C corporation, S corporation or other entity does not change the value of the business.) The appraiser’s report valued Success Co. at $6 million.

Step #3. Take appropriate discounts. Joe is transferring only the 10,000 nonvoting shares to his children in the business. The tax law awards you three separate discounts: a discount for lack of marketability; a minority discount (because the nonvoting stock has no vote, it automatically gets this discount); and finally, a discount because a share of nonvoting stock is worth less than a share of voting stock. Typically, the combined discounts amount to about 40 percent.

So, the value of Success Co.’s nonvoting stock is only $3 million for tax purposes ($5 million times 40 percent equals a $2 million discount).

Step #4. Elect S-corporation status if you are now a C corporation.

Step #5. Transfer only the nonvoting stock to the children using an intentionally defective trust (IDT). An IDT does two great tricks: First, it transfers all of Success Co.’s nonvoting stock to the children tax-free. This is one big deal, saving about $800,000 in taxes for each $1 million of the stock price (in this case, real-dollar tax savings of $2.4 million). Second, because Joe keeps all of the 100 voting shares of Success Co., Joe retains absolute control for as long as he lives.

The above example is just one business-succession situation. There are many variations of the tax-free-transfer strategy to accommodate the endless number of family and business circumstances in real-life situations.

Related Content

In Moldmaking, Mantle Process Addresses Lead Time and Talent Pool

A new process delivered through what looks like a standard machining center promises to streamline machining of injection mold cores and cavities and even answer the declining availability of toolmakers.

Read MoreAll-Around Mill Improves Productivity and Cost for Valve Job

Adopting a mill with a double-negative rake and pockets compatible with multiple insert geometries enabled Progressive Metal Service to increase feed and lower scrap rates for a valve.

Read MoreA Career at the Top Helps Rebuild a Job Shop

A new approach to management propels expansion into Swiss-type and multitasking machining work.

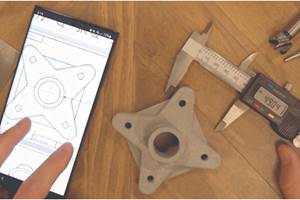

Read MoreFinally, A Comprehensive Software Solution Designed for Small Job Shops

Zel X from Siemens is an integrated software application that consolidates collaboration, design, manufacturing, and operations into a comprehensive, easy-to-use solution. From RFQ to delivery, it’s a more efficient way to handle quotes, manage jobs, make parts, and collaborate with teams of all sizes.

Read MoreRead Next

3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read MoreThe Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More