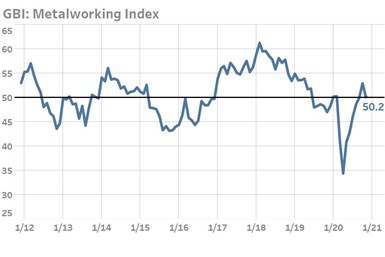

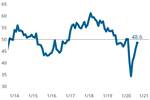

Metalworking Index Signals Slowing Expansion in November 2020

The Gardner Business Index: Metalwork fell to 50.2 in November 2020, indicating that while growth has continued, it is slowing and could turn to another contraction.

The Metalworking Index fell to 50.2 for November 2020 as new orders and production activity flattened after recent months of strong gains.

Photo Credit: Gardner Business Intelligence

The Gardner Business Index (GBI): Metalworking registered its first consecutive pair of expansionary readings since June of 2019 thanks to October and November readings of 52.9 and 50.2, respectively. The Index’s slowing expansion reading in November came largely as a result of falling production and new orders. Despite their declines, both measures remained above 50 during November, indicating that a slightly greater proportion of survey respondents reported improving business conditions than those who reported contracting conditions. Readings for employment, backlogs and exports all fell further below 50, signaling a quickening contraction in these areas of business activity.

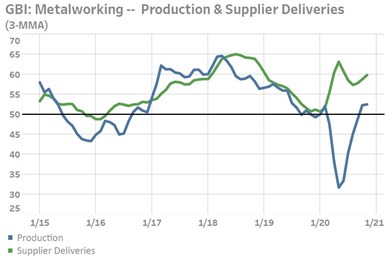

Seasonal shopping demand and COVID vaccine distribution may further complicate the efforts of logistics firms and upstream suppliers to keep manufacturers well stocked with the inputs they need to meet production goals.

Photo Credit: Gardner Business Intelligence

Although the GBI’s history would suggest that the burst of production activity during September and October was largely thanks to expanding new orders activity, the sustained elevation of supplier delivery readings suggests that production growth is being even more stymied by disrupted supply chains. Rising supplier delivery readings indicate lengthening order-to-delivery times by metalworking shops for production inputs. November’s supplier delivery readings, which exceeded 60, extends what is now a 5-month trend of rising supplier delivery readings. Should new orders activity rebound again in the coming months while supply chains are overwhelmed by seasonal orders and now vaccine distribution, it begs the question: how will production be able to keep pace with orders?

The Metalworking Index is unique in its ability to measure the status of the metalworking manufacturing industry on a monthly basis. For this reason, it is one of the industry’s best tools for making data-driven decisions at a time when it is otherwise tempting to make impulsive and emotional decisions. Your participation will enable Gardner to accurately report on the magnitude and duration of COVID-19, including its eventual passing. Gardner Intelligence believes that the Metalworking Index will provide a first glimpse at the dawn which will inevitably come at the end of this dark crisis.

Related Content

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

-

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

-

Metalworking Activity Remained on a Path of Contraction

Steady contraction of production, new orders and backlog drove accelerated contraction in November.

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)