Reshoring, Robots and the New Factory Floor

Plastics processors are adopting robotics in a major way to compensate for a dwindling talent pool and reshored jobs.

For three straight years, the U.S. has set new records in the number and value of robots sold. This surge can be traced to a convergence of issues: the need to reduce labor input to increase competitiveness; a growing tide of work returning to U.S. shores; and that returning work finding inadequate bodies to be completed. That last point is due to an ever-widening skills gap perpetuated by twin issues of retiring boomers and a dearth of new skilled laborers entering the workforce.

“When business picked up after the great recession, No. 1, companies couldn’t get China to deliver goods fast enough,” explains Mike Cicco, general manager of distribution sales at FANUC America, Rochester Hills, Michigan. Some of those same companies had growing concerns over intellectual property security in China, as well as a desire for greater flexibility in their designs.

As those factors pushed them to reshore, however, these companies found domestic suppliers’ workforces had withered in the interim. “People want to bring manufacturing back on shore, but they need to take some of that labor content out to be competitive,” Mr. Cicco says. “All of that led to, ‘We need to highly automate our factories.’ They knew they needed to automate anyway, plus there was a big labor shortage.”

Three Incredible Years

Since 2010, robots have helped U.S. industry address that labor shortage and reduce costs. The North American robotics market recorded its best year ever in 2013, delivering 22,591 robots valued at $1.39 billion, according to the Robotics Industries Assn. (RIA), Ann Arbor, Michigan. Total units in 2013 grew by 11 percent, while sales jumped 7 percent.

RIA reports that the U.S. trails only Japan in its use of automation, with an estimated 228,000 robots now deployed. For perspective on how fast the market is moving, consider that in 2010, when the industry posted its best year since 2007, it did so with orders of 13,174 robots valued at $845.6 million. Compared with 2013, units have exploded by 72 percent while the dollar value has jumped 64 percent.

“The last three years have really been incredible years,” says Keith Torp, director of industrial paint sales at FANUC America.

In his space, which is dominated by automotive work and includes painting of plastic omponents like bumper fascia, Mr. Torp also witnessed the chain reaction sequence of offshoring, financial crash, and sudden return to business.

“If we were to step back to the horrific year of 2008,” Mr. Torp says, “there used to be a lot more of these [paint shops]. Some were automated, and some where manual, but not nearly as many were fully robotized. So, many of those facilities went under—it just took them down—and then as business came back in 2010 and 2011, those that were left were having difficulties meeting the output and quality demands of the Big Three.”

For a time, Mr. Torp says production was sustained by cannibalizing the abandoned paint assets of shuttered shops, but not for long. “The older robots got all used up, and unfortunately, they really were obsolete. People then realized when you put in new technology, the cost benefits are worth more.”

FANUC’s view of the market was echoed by several robotics suppliers contacted by Plastics Technology. At custom automation supplier CBW Automation, Fort Collins, Colorado, which primarily serves the packaging industry but is increasingly undertaking medical-related work, that same sourcing reversal has been apparent to Jim Swim, CBW business manager. Globally, what we’re seeing is a lot of projects coming back to the U.S. that were going away before—a lot,” Mr. Swim says.

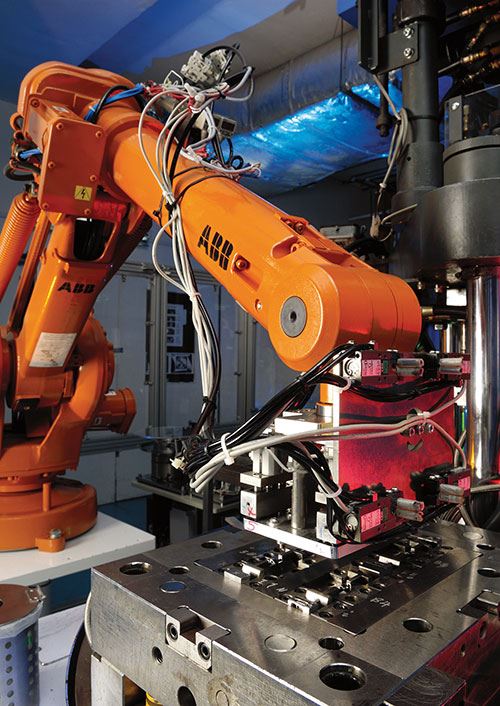

Like FANUC, ABB Group’s automation business supplies a number of industries, with plastics. Among those thriving, according to Helen Ke Feng, ABB’s global industry segment manager, Plastic and Rubber. “What we see in the plastics market over the past several years,” Feng says, “is business that has been steadily growing by about 6-7 percent, aligned to overall plastic processing industry. This growth is driven by investment and also because the plastics industry is still growing as plastics continuously replace other materials.”

MGS Manufacturing, the Germantown, Wisconsin-based injection molder and moldmaker, has been building automation technology since it began molding in 1998. Three years ago, as the rest of the segment boomed, the unit proved successful enough that it was spun off as a separate division. That business, run by Shawn Krenke, has taken off and is currently experiencing growing pains.

“We moved into a location that’s 15,000 square feet,” Mr. Krenke says, “and we didn’t know how we were going to fill it. Now, it’s pretty much completely utilized. At some point, we’re going to need to look for a larger footprint since we’re always adding resources to the team.”

Jitendra Sachania, automation general manager in North America for injection molding machine and robotics supplier Engel, York, Pennsylvania, can track his company’s market growth by checking his frequent flyer miles. “My travel has gone from 20 percent before,” Mr. Sachania says, “to basically 80, 90, 100 percent. Customer requests keep coming in; you have requests for appointments and being onsite. Every week you could be onsite. Every day you could be out there.”

Sepro America, since 2007, the wholly owned U.S. subsidiary of the French automation supplier, had a record 2013, and through the first three months of 2014, it was on pace to set a new high water mark. For Jean-Michel Renaudeau, Sepro’s managing director and partner, the drivers of Sepro’s success in North America are the same the world over.

“Globally we see the same tendencies everywhere, including in the U.S.,” Renaudeau says. “So that means the search for quality. There is always the clear trend for more quality through automation.”

Quality as Job One

“I think quality is probably the number one driver for automation,” Mr. Torp says. “Labor is always a factor, but [FANUC] seems to be really getting opportunities based on quality.”

Engel’s Mr. Sachania notes that in markets like medical, the limitations of human labor, and potential impact on quality, become starker.

“In medical, if Gus is taking little breaks, costs get significantly higher,” Mr. Sachania says. “Now with a robot, it’s lights out. Robots don’t take coffee breaks or stop for lunch, they just run. Ultimately, you also get higher throughput and better quality parts. If you’re doing human inspection, for example, when three different human beings look at part, two might say good and one says bad, but with a robot, it’s always the same.”

At MGS, which began making automation systems for its own internal molding, the pursuit of quality via automation is paramount. “People are buying automation to reduce labor content, but equally as important if not growing to be more important, is controlling their quality,” Mr. Krenke says. “Whether that’s optical inspection or measurements, a lot of [automation] is how well you can introduce and integrate quality control.”

The Birth of Industrial Automation

Nearly 60 years ago, the concept of what would become the world’s first industrial robot was born out of a conversation between inventors George Devol and Joseph Engelberger. By 1961, Engelberger was awarded a patent for his Universal Automation, Unimate, and the machine began work welding parts on a General Motors assembly line in Ewing Township, New Jersey, eliminating human input on a potentially dangerous job.

Five years later, a Unimate appeared on The Tonight Show, doing distinctly human activities—putting a golf ball and directing the band—but it’s taken the five decades between hamming it up with Johnny Carson to today, to begin to realize close collaboration between people and robots, starting with improving their senses.

“We’ve really focused on adding a level of intelligence to the robots to have a lot more flexible behavior,” FANUC’s Mr. Cicco says. “Give the robots a sense of sight and a sense of touch. Integrated vision in two and three dimensions, so they can see what they’re doing and be adaptive to the environment.” In this scenario, 2D vision would allow a robot to pick the appropriate parts from a conveyor for final assembly. In 3D, it could pull them from a mixed pile, using vision to find the necessary component.

When it comes to assembly, that sense of touch would take over.

“So in deflashing,” Mr. Cicco says, “you really want to push along the side of the part with a constant force, so you have a constant focus you apply so you don’t gouge or leave flash. A sensor that fits onto the end of the robot, feels the amount of force, and the robot moves with the changes in the part. A person does that without thinking about it, and we mimic that.”

So what might the future factory floor look like? Mr. Cicco describes an area scanner shooting out a plane of laser light surrounding a robot and eliminating the need for fencing. “The robot can sense when a person gets close, slows down,” Mr. Cicco says, “and when a person gets too close and they could touch, the robot can stop. We’re getting people closer and closer to robots.”

At the press, a robot pulls parts from mold, a person inspects quality, and next to him or her, another robot does assembly, and so on. “Then another person, robot, person, robot,” Mr. Cicco continues. “So when you start getting into assembly, you want people and robots right next to each other, working side by side as it allows.”

The Definition of Performance

Whether the robot is working next to a human or not, automation will be increasingly present on factory floors.

“A good injection molding machine is a well-automated machine,” Sepro’s Renaudeau says. “I do not know molders today who think of having a good machine without having a good robot. It’s the definition of performance today.”

Related Content

Inside the Premium Machine Shop Making Fasteners

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Read MoreBuilding an Automation Solution From the Ground Up

IMTS 2022 provides visitors the opportunity to meet with product experts to design automation solutions from scratch.

Read MoreCNC Machine Shop Honored for Automation, Machine Monitoring

From cobots to machine monitoring, this Top Shop honoree shows that machining technology is about more than the machine tool.

Read MoreLean Approach to Automated Machine Tending Delivers Quicker Paths to Success

Almost any shop can automate at least some of its production, even in low-volume, high-mix applications. The key to getting started is finding the simplest solutions that fit your requirements. It helps to work with an automation partner that understands your needs.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)