MMS Blog

Troubleshooting Differences in Programming Methods, Machine Usage

Regardless of the level of consistency among machines owned by your company, you probably have experienced consistency-related issues. Here are some tips to help solve them.

Read MoreERP Provides Smooth Pathway to Data Security

With the CMMC data security standards looming, machine shops serving the defense industry can turn to ERP to keep business moving.

Read MoreDN Solutions Responds to Labor Shortages, Reshoring, the Automotive Industry and More

At its first in-person DIMF since 2019, DN Solutions showcased a range of new technologies, from automation to machine tools to software. President WJ Kim explains how these products are responses to changes within the company and the manufacturing industry as a whole.

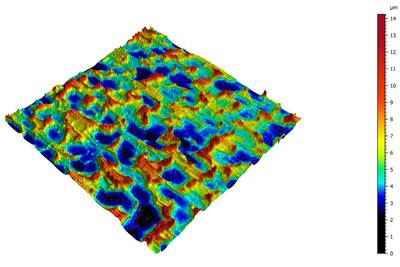

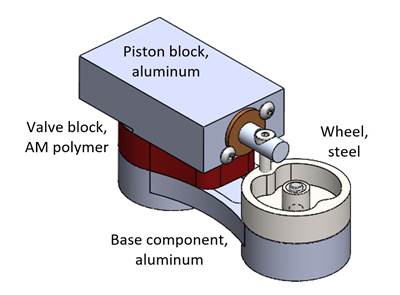

Read MoreMoving from Contact to Noncontact Surface Analysis

2D measurement systems check specific lines for roughness quality, while a 3D surface analysis provides assurance for a broader area — which can avoid costly process disruptions and bonding failure.

Read MoreParts and Programs: Setup for Success

Tips for program and work setups that can simplify adjustments and troubleshooting.

Read MoreTTI Brings Specialty Gear Production In-House with Multiaxis Machining

By investing in a 3+2-axis machine and utilizing simulation software for diagnostic checks, Techtronic Industries turned a four- to ten-week lead time into a one- to two-week lead time.

Read MoreSolve Worker Shortages With ACE Workforce Development

The America’s Cutting Edge (ACE) program is addressing the current shortage in trained and available workers by offering no-cost online and in-person training opportunities in CNC machining and metrology.

Read MoreLights Out Machining With An Automated 5-Axis Cell

Legacy Precision Molds takes us on a tour of their moldbuilding facility. They've recently implemented two automated 5-axis cells for metal and graphite machining that run lights out during nights and weekends.

WatchJoint Ribbon Cutting at Fagor, Danobat Showrooms

Danobat and Fagor co-hosted an inaugural event for their co-located facilities in the Chicago area.

Read MoreHow to Choose the Correct Fixed-Body Plug Gaging Solution

The two types of fixed-body plug gages are both accurate, fast and easy to use. Consider these factors when selecting one for your gaging application.

Read MoreInside the Premium Machine Shop Making Fasteners

AMPG can’t help but take risks — its management doesn’t know how to run machines. But these risks have enabled it to become a runaway success in its market.

Read MoreTips for Designing CNC Programs That Help Operators

The way a G-code program is formatted directly affects the productivity of the CNC people who use them. Design CNC programs that make CNC setup people and operators’ jobs easier.

Read More