Are Increasing Oil Prices Good for U.S. Industry?

The positive impact of oil prices on modern U.S. manufacturing offers an argument for questioning our habitual response to oil price increases.

Which is better for the United States: high oil prices or low ones? For now, the answer is still the latter—but the answer might change as U.S. energy imports and exports increasingly come into balance. OPEC recently announced that it would stop supporting the low oil prices we have been seeing by stepping back from its practice of keeping oil production high. Should we be cheering this news or booing it?

My reflex is certainly to boo it. I grew up being taught that this is the response to expensive oil. My parents remember oil shocks and lines at gas stations, and throughout my own decades as a driver, I’ve seen the price to fill a car’s tank sometimes represent an alarming expense.

And yet, advances in oil and gas extraction in more recent times have helped to make the United States a more significant energy exporter. One result of this is something I’ve seen clearly from my vantage with MMS: a notable amount of domestic manufacturing activity hinges on oil prices being high. Indeed, I’ve heard repeatedly about the struggles shops making oilfield-related hardware have faced in recent years when prices have been low. Some have sought ways to serve the industry differently, some have sought to attract business from different industries, and some have closed altogether. In this sector, higher oil prices would have a welcome, positive effect.

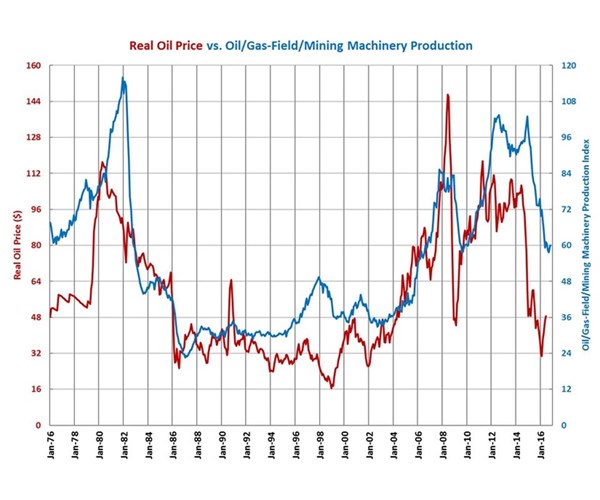

Here is a picture of that effect. This graph, which is based on Federal Reserve data, was created by Gardner Research (source of all the graphs in this post) to show the inflation-adjusted price of oil versus production activity for manufacturers of oil and gas equipment. Statistically, the correlation is about 80 percent, a connection that can be seen here without much difficulty. On this graph, when the oil price rises or falls, the business activity for oilfield equipment producers does the same thing not long after.

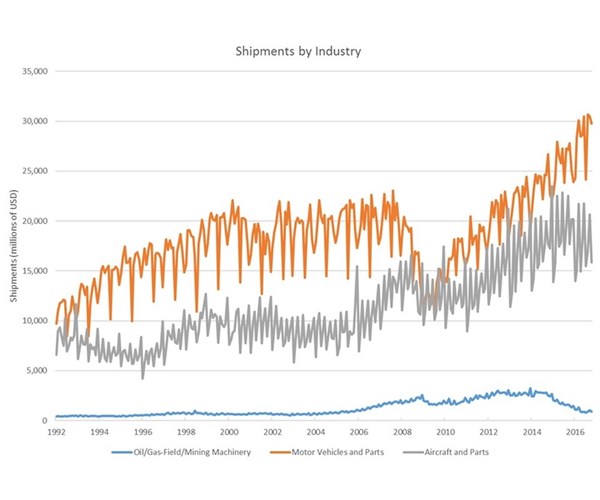

But what is the effect of this more broadly? How much do higher oil prices help (if they even do help) manufacturing overall? This graph offers a clue. It shows how large oilfield manufacturing is relative to other sectors, specifically automotive and aerospace.

In short, relative to cars and planes, making oilfield components is not a large activity. And yet, even in the graph above, the potential effect of a surge in oilfield manufacturing can be seen. Oilfield work has the potential to go from a sliver of the pie that is minuscule overall, to a sliver that—while still small—is large enough to be seen within the pie as a whole.

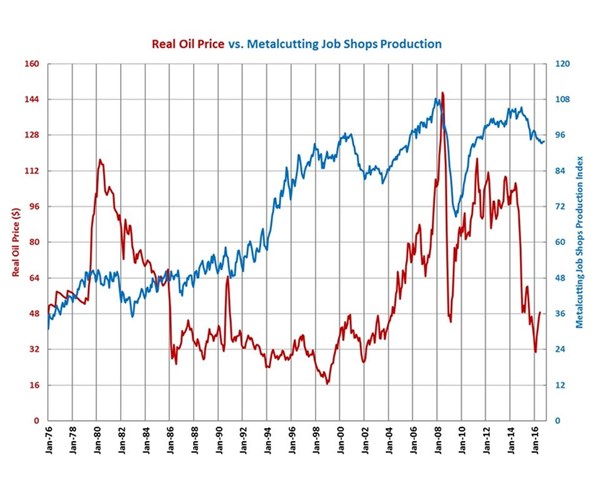

This final graph perhaps illustrates that. Here is the price of oil compared not to oilfield equipment production, but to metalcutting job shop production overall, including production serving automotive, aerospace and everything else. A correlation here is not visibly clear. Statistically, the correlation is 60 percent. That smaller amount of correlation might pick up the domestic oil sector’s impact on manufacturing more broadly. In particular, note that in the most recent years, this graph of metalcutting in total actually shows the same pattern as the graph above for oilfield producers. That is, in the most recent years, as oil price rises or falls, metalcutting activity as a whole soon also does the same thing:

That effect—if it is real and if it is causal (two big “ifs”!)—lends credence to the case that an oil price that is higher than it is now is not as negative a development as we once might have seen it to be.

That is far cry from saying we should root for oil price to rise. It is still true that higher fuel costs would make U.S. residents’ lives more expensive. But as oil production contributes more to the success of U.S. industry over time, the downside of oil price increases gets smaller. When the day comes that the United States is a net exporter of oil products, we might, indeed, find ourselves rooting for more expensive oil.

Related Content

3+3 Air Chuck Features Extended Stroke and Self-Centering

To keep up with the demands of the oil and gas industry, SMW Autoblok introduces BBFZA2G Air Chuck, featuring an extended stroke clamping range and three self-centering jaws.

Read MoreFive-Axis Changes Weldments Into Monolithic One-Piece Parts

Moving from welding to five-axis machining enabled Barbco to redesign its weldments as monolithic one-piece parts with improved strength and repeatability.

Read More4-way Bed Precision Lathe Features Automated Cycles

Long and thin workpieces can be machined without reclamping on this new machine from Weiler, according to the company.

Read MoreDielectric Oil Dramatically Reduces EDM Maintenance

Plagued by repeated small fires that interrupted its wire EDM throughput, this cutting tool manufacturer changed its dielectric oil and both eliminated fires and reduced its oil consumption.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.jpg;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)