Metalworking Activity Contracts Further as Coronavirus Disruption Continues

Index sets back-to-back all-time lows stemming from extended COVID-19 turbulence.

The Gardner Business Index (GBI): Metalworking reported back-to-back monthly all-time lows as it fell to 34.4, surpassing the prior all-time low by nearly 10 points. The coronavirus-induced trends from March worsened in the April data.

Metalworking Business Index: The metalworking industry continues to be challenged by the COVID-19 pandemic. As economies reopen in the near-term, we expect the Metalworking Index to be an early indicator of improving conditions.

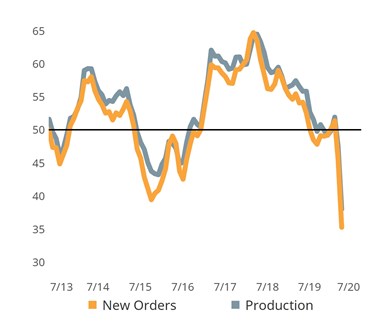

Gardner Intelligence’s review of the six underlying industry components — whose average is calculated for the reading — indicates that the index was brought lower by changes in new orders, production and backlogs. New orders and production are considered directionally leading indicators of backlogs and employment in following months.

As with last month’s report, it is important to remember that these readings represent the breadth of change occurring the metalworking industry is experiencing and are not to be confused with the rate of decline taking place. These low readings indicate only that a large proportion of metalworking manufacturers reported some decreased level of business activity without quantifying the magnitude of the downward change.

New Orders and Production Extend March’s Contractionary Readings: The Metalworking Index set back-to-back all-time lows at the end of April led by a further decline in new orders and production activity. Both measures are harbingers of the future movement of production and employment activity.

The reading for supplier deliveries also extended its upward progression from March. As addressed in our March report, the world’s efforts to slow the spread of COVID-19 has significantly disrupted supply chains worldwide. It is this disruption that is slowing deliveries and thereby raising the supplier delivery reading. During the course of a normal business cycle, the supplier delivery measure is designed to increase when strong demand for upstream goods results in growing upstream backlogs. As these backlogs grow, they lengthen delivery times for input goods. It is for this reason that the supplier delivery is calculated differently from its peer components.

Related Content

-

Mixed Bag Ahead for US Metalworking Economy

While what has been an extraordinarily robust manufacturing economy has softened in recent months, and the near-term outlook appears to be more of the same, the overall scenario remains strong. Even a possible recession next year does not appear to be an obstacle to continued growth over the next few years.

-

Metalworking Activity Contracted in November

Contraction was hard to dodge with metalworking activity expansion steadily slowing since March.

-

Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

.jpg;maxWidth=970;quality=90)

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)