Business Succession

This three-step plan will get your company and estate into the hands of your heirs with as little tax burden as possible.

Business succession. We’ve covered this topic many times in this column, but it’s still the No. 1 question readers ask about: “How do I transfer my business to my kids without getting killed by taxes?”

Here’s a true tax-victory story of how to do it and do it right. Read slowly if you own all or part of a family business.

Joe, the 61-year-old owner of Success Co. (a C corporation), is married to Mary, 53. Their son Sam, 31, has worked in the business since he was 15 and owns one share of Success Co. stock. Joe owns the remaining 99 shares. The business has been professionally valued at about $6.5 million and has enjoyed about 10 percent net profit growth each of the past five years. This profit growth is expected to continue into the future. Joe’s total net worth is about $17.5 million and includes a residence, various investments (including real estate leased to Success Co.,

and a large portfolio of stocks and bonds) and $1.9 million in a profit-sharing plan.

Joe’s CPA and lawyer suggested two different business succession plans, each of which centers around a $4 million life insurance policy on Joe. In Plan 1, this insurance policy would be owned by Sam, but Joe would gift to Sam the annual premium amounts. Upon Joe’s death, Sam would buy the 99 shares of Success Co. from Joe’s estate for $4 million (after discounts allowed by tax laws). Under Plan 2, Success Co. would own the $4 million policy as key man insurance and would redeem the 99 shares from Joe’s estate.

The ultimate result of either plan would be exactly the same: Sam would own 100 percent of Success Co., and Joe’s estate would have

$4 million in cash from the proceeds of the life insurance proceeds instead of $4 million in stock. In addition, Joe’s estate would not owe income tax on the sale of the stock, because the estate would get a raised basis equal to the fair market value of the 99 shares on the date of Joe’s death. Likewise, there will be no estate tax, because

the $4 million of insurance proceeds will wind up in Mary’s trust and receive the benefits of a 100-percent-tax-free marital deduction.

These plans, or some variations of them, are the most popular way of transferring a family business to the next generation. There are two problems with them that cause us to turn thumbs down on such plans, however:

1. The value of the stock will probably continue to grow, and the excess value over its current $4 million value will enrich the IRS by 40 cents for each $1 of the excess (using 2014 estate tax rates). That’s $400,000 per $1 million in unnecessary estate taxes!

2. After Mary dies, the IRS will be guaranteed another big payday: 40 percent of the $4 million in life insurance. That’s right—the IRS will get $1.6 million and the family only $2.4 million!

(Note: The tax rates may change, thus changing the numbers a bit, but the concepts will stay the same.)

To transfer the business and eventually his estate with as little tax consequence as possible, we put together a three-step plan for Joe and Success Co. that any business owner in a similar situation should consider:

Step 1. Success Co., which had been a C corporation, filed to become an S corporation, which is subject to less tax. We recapitalized the company into 100 shares of voting stock and 20,000 shares of nonvoting stock, whereby Joe will own 99 percent of the voting stock (99 shares) and therefore retain control of Success Co. for the rest of his life.

Joe transferred the nonvoting stock to an intentionally defective trust (IDT) in exchange for a $4-million note, removing the nonvoting stock from his estate. The IDT owns the $4 million policy and pays the premium. After Joe’s note is paid, the IDT moves the nonvoting stock to Sam, using Success Co.’s cash flow. All of these transactions are free of both income and estate taxes for Joe and Sam.

Step 2. We used the $2.1 million Joe has in an IRA to implement a strategy we call a “retirement plan rescue” (RPR), acquiring $6 million of second-to-die life insurance on both Joe and Mary. We also created an irrevocable life insurance trust (ILIT) to own the insurance. None of the insurance proceeds will be subject to income or estate taxes, so all $6 million of it will go to Joe and Mary’s family tax-free.

Step 3. We created a family limited partnership (FLIP) to hold Joe’s investments, both real estate and a securities portfolio worth about $8 million combined, and started an annual gift-giving program to give limited partnership interests in the FLIP to Joe and Mary’s other two children, who are not involved in Success Co., at the rate of $28,000 per child.

The beauty of a FLIP is that tax laws allow a 35-percent discount on its value, so Joe’s

$8 million FLIP is discounted $2.8 million and valued at only $5.2 million for tax purposes.

The three-step plan we substituted for the original two proposed plans will increase the amount of wealth Joe and Mary will leave to their family by an estimated $5.5 million. Best of all, the new plan has zero impact on Joe and Mary’s lifestyle, and they retain absolute control of all their assets, including Success Co., for as long as either of them is alive.

Related Content

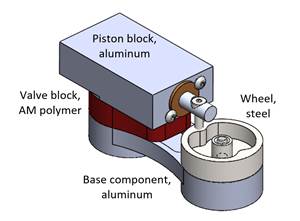

In Moldmaking, Mantle Process Addresses Lead Time and Talent Pool

A new process delivered through what looks like a standard machining center promises to streamline machining of injection mold cores and cavities and even answer the declining availability of toolmakers.

Read MoreWill the “Great Resignation” Become an Opportunity for Manufacturers? Get Ready for the Returning 3 Million

The Great Resignation will become a Great Reapplication when employees currently able to stay out of the workforce return to it looking for something better. Machining employers that are already evaluating candidates for fit, without demanding specific skills coming in, might be positioned well to draw upon this wave.

Read MoreSolve Worker Shortages With ACE Workforce Development

The America’s Cutting Edge (ACE) program is addressing the current shortage in trained and available workers by offering no-cost online and in-person training opportunities in CNC machining and metrology.

Read MoreSame Headcount, Double the Sales: Successful Job Shop Automation

Doubling sales requires more than just robots. Pro Products’ staff works in tandem with robots, performing inspection and other value-added activities.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.png;maxWidth=300;quality=90)