How To Solve Your Estate Tax Problems

One perk of writing a tax column is receiving phone calls from readers, each with his/her own specific problems, concerns and questions. I find that the greatest reward I receive is being able to help almost all of the callers.

One perk of writing a tax column is receiving phone calls from readers, each with his/her own specific problems, concerns and questions. I find that the greatest reward I receive is being able to help almost all of the callers.

Over the years, I've found that readers typically call for three main reasons: to maintain their or their spouse's lifestyle for as long as they live; to eliminate the impact of estate taxes; and to transfer their businesses to the kids without paying hefty taxes.

Of course there are other reasons, but one common interest is prevalent—the thirst for more knowledge and information about financial concerns. What's even more interesting is that almost every caller has the same (emotional) desires, wants and needs—how to treat the business and non-business kids fairly, how to ensure that a son-in-law or a daughter-in-law never owns any part of the business and so on. This holds true whether the caller is worth $1 million or $50 million.

On the other hand, when it comes to the technical stuff—solving various tax/economic complexities—discretionary capital (cash-like investments) and net worth make a big difference.

Callers invariably ask how I do what I do. First of all, I have a network of consulting experts, including lawyers (who process the documents), insurance consultants (who search the marketplace to find the appropriate insurance products) and valuation experts (who value clients' businesses when necessary). Using the expertise of this network, I structure client plans and then write and offer seminars about how the network (legally) battles the IRS.

My savior is not only the network, but my Web site, www.taxsecretsofthewealthy.com, a natural extension of this column. Here you'll find a wealth of information, most of which is free. This article shows you how to navigate the Web site in order to learn how to overcome tax and economic concerns.

Based on net worth, callers generally fall into four categories: those worth less than $3 million; those worth $3 million to $10 million (becoming wealthy); those worth $10 million to $25 million (medium wealthy); and those worth $25 million to $100 million (very wealthy). Occasionally, readers who are worth more than $100 million call us. For our purposes, we'll label these folks the "mega-wealthy."

Once you reach the Web site, read the letter starting on the home page. Next, return to the home page and click on "Learn more." You're welcome to browse and download the entire site if you'd like, but what follows focuses on what will be most effective depending on the amount of your net worth.

If you are worth less than $3 million, click on "Individual strategies, chapters . . . ." Next, scroll down almost to the end, where it says "Applying the strategies to the little guy." It should answer all of your questions.

If you are in any category of the wealthy, read the "Special Report," which is also located on the "Learn more" page. Additional information about "Tax Secrets of the Wealthy" can be found here as well. Unless you have a deep desire to learn the ins and outs of estate planning, succession planning and related areas (or you want a copy for your professional advisors), do not buy it.

Prior to spending money on the above, read the free 75-plus pages on the Web site. We suggest that you start with the "Free Newsletter" (select our home page).

What if you still have a question? Again, begin on the home page; then click on, "Do you have a burning problem or question." After selecting "Free Newsletter," complete the form and I'll call you.

For those readers who are worth $10 million (or more), I have a special note. You may want to read "Wealthy by Any Definition" and "Personally Designed Philanthropy (How the rich profit by giving to charity)" at your leisure. Here, you'll discover how to use your current wealth to enrich your family with tax-free wealth while enriching charity at the same time.

Related Content

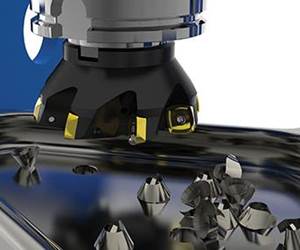

10 Tips for Titanium

Simple process considerations can increase your productivity in milling titanium alloys.

Read MoreKey CNC Concept No. 1—The Fundamentals Of Computer Numerical Control

Though the thrust of this presentation is to teach you CNC usage, it helps to understand why these sophisticated machines are so important. Here are but a few of the more important benefits offered by CNC equipment.

Read MoreA New Milling 101: Milling Forces and Formulas

The forces involved in the milling process can be quantified, thus allowing mathematical tools to predict and control these forces. Formulas for calculating these forces accurately make it possible to optimize the quality of milling operations.

Read More6 Steps to Take Before Creating a CNC Program

Any time saved by skipping preparation for programming can be easily lost when the program makes it to the machine. Follow these steps to ensure success.

Read MoreRead Next

The Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read More

.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)