Play The Tax Game Right: Get By Giving

Here's how to get a full deduction for what someone else pays. When you give property to a charity, you are entitled to a deduction equal to the property's fair market value on the date of the gift.

Here's how to get a full deduction for what someone else pays. When you give property to a charity, you are entitled to a deduction equal to the property's fair market value on the date of the gift. Your cost or how you acquired the property is immaterial.

Example: Years ago. when you started Your Co., the stock was worth $1 a share. You owned 100 percent then, and still do today. But today it's worth $200 per share. If you sold 100 shares for $20,000, the capital gains tax would be about $5600. But, if you donate the stock to your favorite charity, the capital gains tax is ignored and you get the full $20,000 deduction. In a 40 percent tax bracket, that means you would pocket about $8,000.

Sometimes, it's not easy to find a buyer for the stock of your family business when you want to sell only a few shares. In fact, you may have trouble trying to give it away because the charity won't be able to sell it either.

This is where the "charitable bailout" comes in. You arrange to have your corporation buy the stock from the charity at its full value. Result: You unlock $20,000 from the corporation. Caution: Be careful about the deal you make with the charity. You lose your tax benefits if the charity is obliged to sell the stock to the corporation. It's okay to nix a sale to anyone else, but the charity must at least have the option of keeping the stock. Chances are the charity will want to cash the stock in faster than you want it back, but you won't avoid the capital gains tax if you make the donation contingent upon the charity selling the stock back to your corporation.

When the smoke clears, Your Co. has, in fact, paid for your $20,000-in reality, tax-free dividend-charitable deduction, And who still owns 100 percent of Co.? You do. A great tax deal all around.

Qualified Plans: Tax Deal Or Trap?

There are many types of qualified plans; pension, profit-sharing, 401(k) and IRAs are the most popular. True enough, they are a great tax strategy if you ultimately need the plan funds for retirement and (1) you are in a low tax bracket when you take the funds out of the plant and (2) your estate is not large enough to kick up an estate tax problem. Perfect for over 90 percent of the taxpayers.

But what happens if you are in the highest income tax bracket when you retire and you have an estate tax problem (say the highest barcket of 55 percent)? Sorry. No matter when the funds are taken out of the plan (during life or after your death), the IRS gets 73 percent of the dollars in your qualified plans.

Here's how one client used a subtrust. Joe and his wife Mary are both 60 years old. They needed $2 million in second-to-die life insurance to solve their estate tax problem. the premium cost was $22,400 per year. Joe's profit-sharing plan had $400,000 in it. Joe knew his $400,000 would only net his family $108,000.

Here's what we did. We set up a subtrust as part of the profit-sharing plan (Plan). The subtrust will pay the annual premium after receiving the funds from the Plan. Since the policy is actually an asset of the Plan, the annual premium payment is a tax-free transaction.

When both Joe and Mary pass on, the family will receive the full $2 million policy proceeds. No income tax. No income tax. No estate tax. The subtrust tax strategy, in this case, actually turns $108,000 after taxes into $2 million after taxes.

If you have $200,000 (or more) in one or more qualified plans and have an estate tax problem, you are in a tax trap.

Related Content

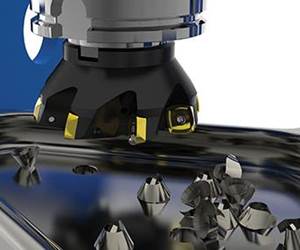

Choosing The Right Grinding Wheel

Understanding grinding wheel fundamentals will help you choose the right wheel for the job.

Read More7 CNC Parameters You Should Know

Parameters tell the CNC every little detail about the specific machine tool being used, and how all CNC features and functions are to be utilized.

Read MoreSelecting The Right Welder

Many machine shops, on occasion, have a need for welding. It may be for maintenance purposes, repair or to fill the odd contract. This story is a welding process primer for those shops whose main business isn't welding but need to know some basics.

Read More10 Tips for Titanium

Simple process considerations can increase your productivity in milling titanium alloys.

Read MoreRead Next

3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read MoreThe Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More

.jpg;maxWidth=300;quality=90)

.jpg;maxWidth=300;quality=90)