June 2019 Metalworking Index Advances

Expanding activity in production leads Index growth.

Share

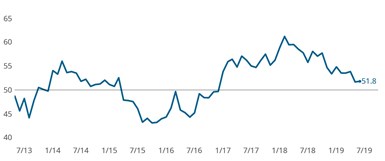

The Gardner Business Index (GBI): Metalworking registered 51.8 in June, signaling marginally greater business activity compared to the prior month. Index readings above 50 indicate expanding activity while values below 50 indicate contracting activity. The Index is calculated as an average of its components. Gardner Intelligence’s review of these underlying components observed that the Index was supported by expanding activity in production, supplier deliveries and employment. The reading for new orders registered slightly below the average of the components. The Index was pulled down by the ongoing contraction in exports and backlogs.

Metalworking Business Index: The Metalworking Index was supported by production, supplier deliveries and employment. New orders activity fell slightly below the average reading of the six components which constitute the total index.

The Metalworking Index was supported by production, supplier deliveries and employment. New orders activity fell slightly below the average reading of the six components which constitute the total index.

Metalworking Business Index: The Metalworking Index was supported by production, supplier deliveries and employment. New orders activity fell slightly below the average reading of the six components which constitute the total index.

Data collected in June extended many of the trends observed in the data over the last six to 12 months. Supplier deliveries in 2019 have continued to closely track with production activity readings. This comes after supplier deliveries expanded far faster than any other component during the second half of 2018, as manufacturers rushed to fill new orders. Similar readings for both the supplier deliveries and production components in 2019 suggest that manufacturers have astutely moderated their inventory levels, thereby preventing a glut of inventory.

The gap between production and new orders activity has widened since the beginning of 2019. This gap has been made possible as shops have drawn down their inventory of backlog orders.

The gap between production and new orders activity has widened since the beginning of 2019. This gap has been made possible as shops have drawn down their inventory of backlog orders.

Exports registered their fastest rate of contraction since August 2016. A June increase in production activity coupled with a simultaneous slowdown in new orders growth contributed to another month of contracting backlogs.

Related Content

-

Optimism Grows as Metalworking Index Improves Again in November

A sharp increase in future business expectations underscores hopeful conditions in 2025.

-

Metalworking Index Reaches Expansion for First Time in 2 Years

After two years of contraction, the Metalworking Index has finally turned a corner. A recovery that started in October has reached a milestone, fueled by increased production and new orders, signaling cautious optimism for the industry.

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

.jpg;width=70;height=70;mode=crop)

-02.jpg;maxWidth=300;quality=90)

-02.jpg;maxWidth=970;quality=90)