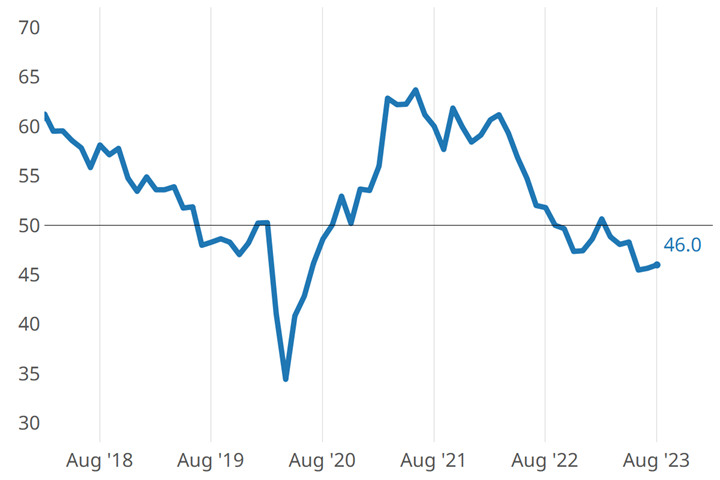

Metalworking Activity Continued to Contract Steadily in August

The degrees of accelerated contraction are relatively minor, contributing to a mostly stable index despite the number of components contracting.

Share

Metalworking activity contracted again in August, closing at 46.0, about the same as July’s 45.6 and June’s 45.4. Four of six components contracted faster again in August. The degrees of accelerated contraction are relatively minor, contributing to a mostly stable overall index despite the number of components contracting.

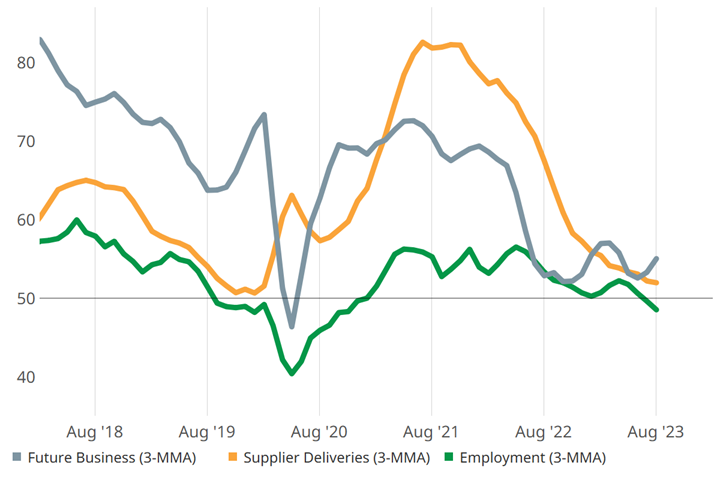

Employment solidly contracted at a faster rate in August, in part correcting for pandemic-inspired shortages that are getting sorted out and reflecting a less bullish economic outlook. Exports are unremarkable, humming along at a consistently contracting rate for four months now. Supplier deliveries were the exception again in August — still lengthening, but at a rate that has been slowing less dramatically each month since March. Future business expectation, a separate but related non-GBI metric, provided encouragement in August, expanding at a faster rate for the second month in a row.

Metalworking GBI in August showed stable contraction. Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Activity Trends Downward in May

Accelerated contraction and declines in business optimism span manufacturing segments. Odds are that broad-reaching economic factors are at play.

-

Metalworking Activity Trends Down Again in June

The Metalworking Index closed at 44.3 in June, down 1.2 points relative to May, marking a 2024 low.

-

Metalworking Activity Sees Minor Drop in June

Positive results in employment trends and production are offset by supplier deliveries, among other components.