Metalworking Production Impaired by Payrolls and Supply Chain

Stalling payrolls and congested supply chains weigh on production, as the metalworking index signals slowing expansion.

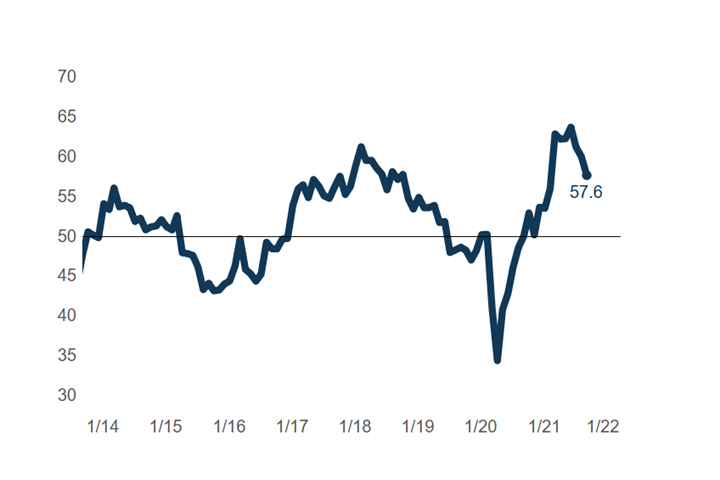

The Gardner Business Index: Metalworking closed lower for September, ending at 57.6.

September Gardner Business Index: Metalworking

The Metalworking Index signaled slowing expansion in business activity for a third consecutive month. Disrupted supply chains and difficult labor conditions are severely impacting production and keeping backlogs elevated.

The decline was caused by challenging supply chain and employment conditions along with a slowing expansion in new orders. Export orders activity contracted at its fastest pace since January, further slowing the expansion in total new orders activity. Employment activity also registered contracting activity for the first time since November 2020. Further impacting production levels, the latest supply chain reading set an all-new high, indicating more wide-spread supply chain disruption to the metalworking industry than at any prior time in recorded history.

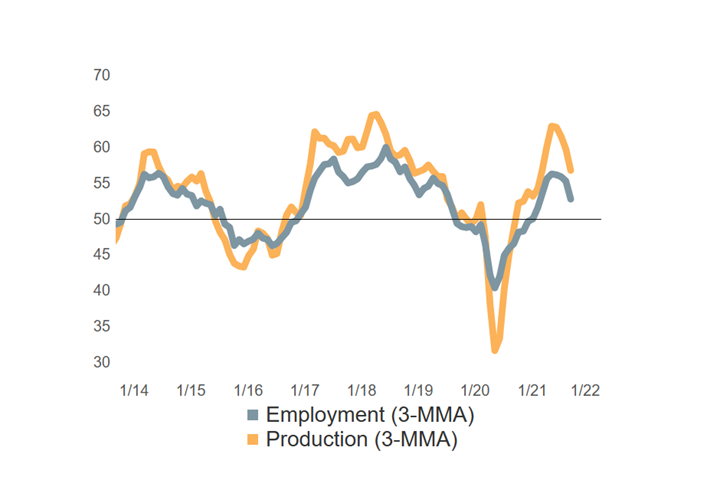

Stalling in Employment Expansion Cuts into Production Activity

The third quarter of 2021 saw month-on-month slowing in employment activity, culminating in a September contraction. Hiring and supply chain challenges starved production of its essential inputs, widening the gap between supply and demand.

Manufacturing production challenges that initially started with painfully disrupted supply chains in late-2020 have since intensified in recent months as month-on-month hiring activity expansion has slowed to a near-crawl, arguably pulling down production activity. September’s employment reading of just below 50 indicated that the proportion of metalworking job shops that reported shrinking payrolls activity was slightly greater than the proportion of firms that increased payrolls, while all others reported ‘no change.’ Until the balance between materials, labor and demand is restored, the industry will continue to face a production deficit and rising backlogs.

Related Content

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

-

Metalworking Activity Continues its Roller Coaster Year of Contraction

October marks a full year of metalworking activity contracting, barring just one isolated month of reprieve in February.

.jpg;maxWidth=970;quality=90)

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)

.png;maxWidth=300;quality=90)

.jpg;maxWidth=970;quality=90)