Metalworking Activity is Nearing a Full Year of Contraction

Metalworking activity has contracted since October of 2022.

Share

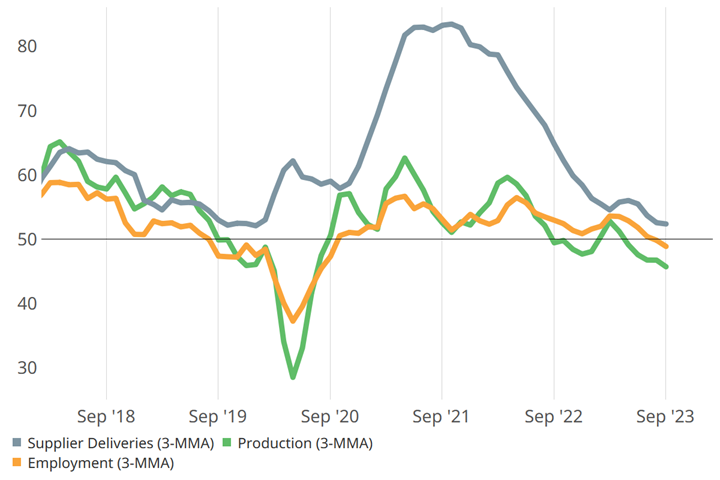

Metalworking activity contracted again in September, closing at 44.8, down from August’s 46.0. Metalworking activity has, in fact, contracted since October of 2022, generally at an accelerated rate each month. February 2023 saw a slight reprieve (flat), which proved to be a one-month fluke.

All components continued to contract in September, with the exception of supplier deliveries which have been marching to their own tune for months. The rate at which components contracted in September was generally steady, thereby minimizing the drop in overall GBI. It will be interesting to follow employment, the newest member of contraction territory. Expansion in employment that had been driven by workforce dynamics during the COVID-19 pandemic may be contracting to normalize and/or as a function of rising costs/interest rates. Future business expectations, which were included in the survey but not the GBI calculation, continued to expand at the same rate as August.

Metalworking GBI contracted again in September, at a slightly faster rate than the previous month. Photo Credit: Gardner Intelligence

Employment, which parallels production with about a two-month lag, leveled in its third month of contraction. Supplier deliveries continued to slow on the lengthening trajectory (3-MMA = three-month moving averages). Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Index Continues Climb into 2025

Steady improvement is short of expansion but component readings and future outlook remain strong.

-

Metalworking Activity Sees Minor Drop in June

Positive results in employment trends and production are offset by supplier deliveries, among other components.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.