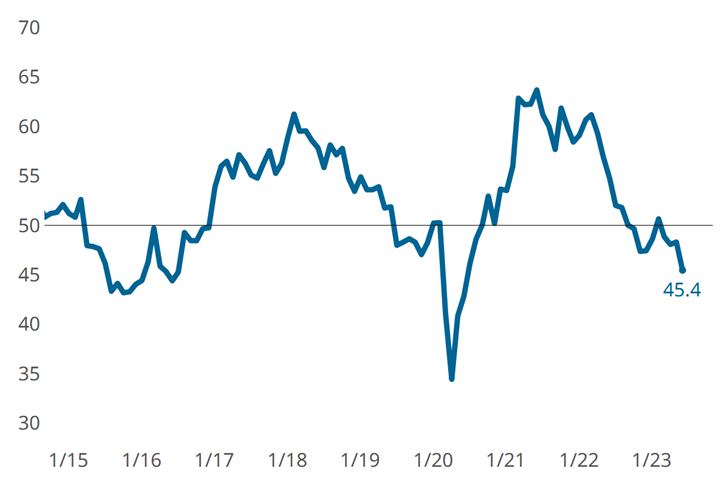

Metalworking Activity Contracts With the Components in June

Components that contracted include new orders, backlog and production, landing on low values last seen at the start of 2023.

Share

Metalworking activity contracted faster in June, closing at 45.4 — down three points from May’s 48.3.

With key components contracting for several months straight, some coming up on a year now, it is surprising that overall metalworking activity did not dip earlier and more dramatically. It is now at its lowest point in three years. Components that contracted did so faster in June, including new orders, backlog and production, landing on low values last seen at the start of 2023.

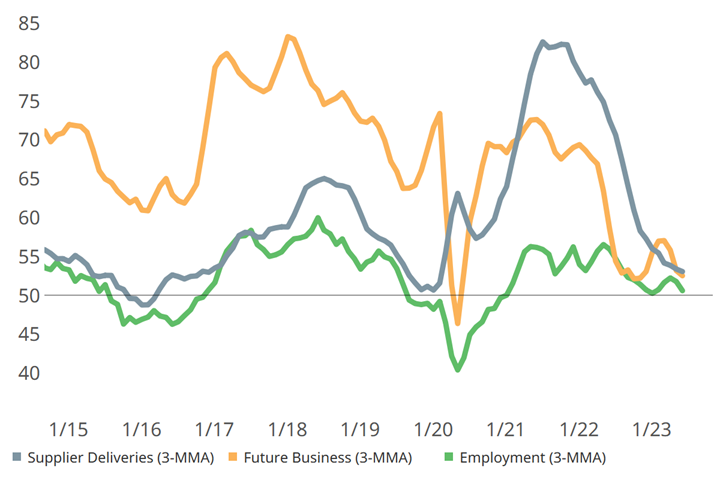

Supplier deliveries continued to lengthen, but more slowly. Significantly improved supply chain operations and the absence of booming metalworking activity suggest deliveries may even shorten if it becomes easier and easier for suppliers to keep up.

A short labor supply typically facilitates expansion of the employment component as shops are almost always hiring. That said, if inflation and other economic forces apply pressure on spending, a tight labor force may prove to be ‘just right.’

Separate but related non-GBI metric, future business, expanded again in June, but at a slower rate, still threatening to contract.

Metalworking GBI in June is down from May, contracting for a fourth month in a row. Photo Credit: Gardner Intelligence

Related Content

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.