5 Reasons Why Machine Shop Ownership Is Changing

Mergers, acquisitions and other ownership changes are an effect of Boomer-age shop owners retiring, but only in part. Also important: The way we think about machining has changed.

Share

Machining businesses have been changing ownership or leadership with greater frequency in the last couple of years than at any other time during the quarter-century I’ve been watching metalworking. We are in a season of fundamental change for machine shops — change at the tops of these enterprises — and that change continues today. The most recent example I encountered was a soft transition, a shop owner I regard highly describing to me his determination to step back and let his daughters now run things. Other cases have involved more formal acquisitions and mergers. I can’t prove the claim I am making here; machine shops are often small, independent businesses, and I do not know of a data set that quantifies their rate of ownership change. But anecdotally, the conclusion has been hard to miss. I see shops today more frequently brandishing new names or taglines indicating recent ownership change or working through ongoing ownership transitions.

Mike Budde, who in the past has worked for other manufacturers, became a manufacturing business owner when he purchased the former Toolrite Manufacturing and turned it into Budde Precision Machining. His story is one of our cases of machine shop ownership change.

We wanted to understand and bear witness to this. Several recently posted articles (and one video) all report on machine shops that have freshly gone through a change in ownership. The types of these changes vary: We found examples of a merger, acquisition, generation change, a shop owned by one company being bought by another, a shop being purchased by another shop, and a shop that has been purchased by an entrepreneur.

Why is this happening? I believe several factors are coming together at once, some of them obvious and some less so. The aging into retirement of shop owners of the Baby Boom generation is obviously a contributing factor, but perhaps less of a factor than we might imagine. Industry as a whole, across various market sectors, has been slowly changing in the way it views, values and organizes manufacturing and machining. That, combined with demographics, as well as technology, is producing these shifts in who owns and runs machine shops.

What follows is a bigger picture. Here are more of the factors I believe contribute to this trend:

1. Demographics

We all understand this one. A large cohort of the population, including a large share of machine shop owners, was born between 1946 and 1964. They are at or close to retirement age now.

This transition has come more slowly than expected. Wisdom in how to size up a machine tool or a machining job, as well as the trust of connections who are sources of machining work, all are assets that improve with age. Some shop owners approaching 65 found themselves at the most valuable parts of their careers, so they continued.

2. Systemization

The way the leaders of machining facilities think about these organizations has fundamentally changed in some cases. Is a machine shop a collection of machine tools run by skilled people adept at applying them? Maybe yes. In this view, the machines matter a great deal in defining the shop. Or, instead, is a machine shop the set of resources that is governed by an enterprise-wide system for making parts? The distinction might seem subtle, but it is meaningful for shop leaders who have made this shift. And market-specialized quality standards such as AS-9100 encourage this paradigm change. In the latter view of the machine shop, the machine tools matter, but the system matters more — and machines and people succeed according to how well they work effectively within the system.

This better defining and disciplining of how a machining facility runs results in shops that function more like integrated units rather than islands around each machine, and therefore it results in shops that are easier to redeploy for new purposes or new owners. The system itself, once proven, might also be the template for building upon an acquired shop.

One category of technology is so valuable here that it might merit attention as a separate item on this list: enterprise resource planning (ERP) software. Shops have gotten more serious about ERP in recent years. Commitment to an ERP system, and using that system to organize all a shop’s departments and operations, makes it easy for a shop to integrate its efforts with those of another shop in another location running on the same platform. If two shops have the same ERP system and follow the same commitment and conventions in using it, then in a very real way their language, culture and thinking are close to alike.

3. Reshoring

Cases of parts machined overseas that have literally been relocated to the U.S. might be uncommon, but that narrow view of reshoring overlooks the extent to which decisions about new production frequently favor domestic manufacturing. Manufacturing is migrating as new work gradually replaces old — a shift that was underway even before the pandemic taught the nation about supply chain vulnerability — and that migration favors acquisition. OEMs that want to hold manufacturing closer either acquire manufacturers who were formerly independent, or seek domestic suppliers that are large enough (perhaps because of their own merger or acquisition) to efficiently supply their needs.

4. Changing Attitude

The negative spirit once associated with manufacturing — dreary work, in decline, etc. — is now largely gone. That impression, as false as it always may have been, had an effect on the desirability of investing in manufacturing, and this cloud is lifting.

Today, the view of manufacturing by people under 40 is more fair. Plenty recognize it as an area of opportunity, an area of advancing technology such as additive manufacturing and the chance for significantly greater automation, and a pursuit that is in ascendancy given the trends of reshoring and reexamination of supply chains. Both financial investors looking for growth opportunities and entrepreneurial investors looking to commit their energy and attention are drawn to manufacturing now.

5. Changing Reach

Machining used to be more regional. In earlier decades, a shop was more likely to get its work from customers in and around its home city. For many shops, of course, this is still true. But to a large extent, shops have shifted their attention outside their communities, focusing instead on customers nationally within the sectors the shop can serve well. And several pressures arise from this change in focus.

For example, within a region, a shop offering limited types of machining services can find the work just for these operations. But OEM customers outside the region are likely to prefer a one-stop shop with many services — a need encouraging the shop to merge or acquire. In addition, focusing on a particular sector leads to sector-specific costs that are easier to amortize across a larger organization (back again to quality certifications). Then there is simply sales and marketing: This, too, becomes a more sophisticated effort that makes more sense in the service of a larger organization.

In other words, much more than demographics is happening to drive machine shops’ changes in ownership. A new generation of shop owners is arriving, to be sure. But at the same time, shops are acquiring and being acquired because opportunities favor this, because technology and systemization facilitate it, and because how we think about machining has changed.

Related Content

Setting Up a Small Shop for Big Growth

Metal Trade Solutions is laying a foundation to grow by determining standard tools and workholding, and fully implementing technology.

Read MoreHow to Succeed as a Small Swiss Shop: Top Shops 2025

Can small shops succeed with advanced machine tools and software? If so, how do they do it? Read on to learn the strategies that have helped Midway Swiss Turn, our 2025 Top Shops Honoree in Shopfloor Practices, thrive.

Read MoreAerospace Shop Thrives with Five-Axis, AI and a New ERP

Within three years, MSP Manufacturing has grown from only having three-axis mills to being five-axis capable with cobots, AI-powered programming and an overhauled ERP. What kind of benefits do these capabilities bring? Find out in our coverage of MSP Manufacturing.

Read MoreHow a Family-Owned Tooling Company Competes with Global Giants (Includes Video)

Not ready to go digital? Consider this: With Siemens NX ecosystem, precision shop D’Andrea cut its programming time by 50% and is able to compete globally—even against industry giants.

Read MoreRead Next

Video: Succession Planning, Stewardship and Generation Change in Machine Shops

Leaders of Indiana Precision Grinding describe lessons learned related to succession planning and how the upcoming generation found its commitment to the business.

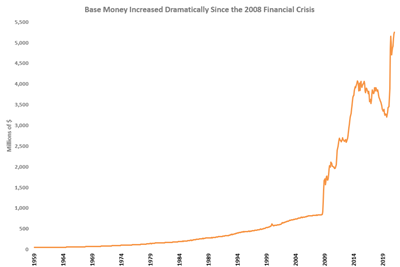

Read MoreAnother Reason Machine Shop Ownership is Changing: Cheap Money

Once largely overlooked by investors, manufacturing businesses now present potentially attractive destinations for dollars seeking returns — and dollars are more available than ever before.

Read MorePrototyping is the Path from Tooling to Production Work

As a new owner takes over a tooling shop, he must balance the company’s foundation with his goal of expanding the shop’s capacity to also take on production work.

Read More

.png;maxWidth=300;quality=90)