Another Reason Machine Shop Ownership is Changing: Cheap Money

Once largely overlooked by investors, manufacturing businesses now present potentially attractive destinations for dollars seeking returns — and dollars are more available than ever before.

In an earlier post, Peter Zelinski cited five factors contributing to the increased activity we have seen in mergers, acquisitions and other ownership changes for machines shops. His list includes demographics; the greater discipline and systemization of shops; and changing attitudes about manufacturing. I wholeheartedly agree with each of these factors. However, I believe there is another factor that overarches all the factors Peter writes about in his post. That overarching factor is cheap money.

Since we use money to buy goods and services, we typically don’t think of money as being cheap or expensive. Yet, money is a good too. And like other goods, the “price” of money is affected by the laws of supply and demand.

All other things being equal, an increase in the supply of money leads to a decrease in the price of money. So, what has happened to the supply of money? It has gone up — a lot!

The chart above shows base money, essentially the physical money we carry around in our wallet, of the United States. Note that the scale in is in millions of dollars, which means the actual figures represent trillions of dollars. The money supply that we actually use to buy goods and services is even larger since that amount includes all the money in checking and savings accounts among other financial instruments, but the graph above illustrates the extent of recent change.

Prior to the start of the financial crisis in 2008, base money in the United States was just under $1 trillion. You can see that the amount of base money had steadily increased year after year up to that point, as it had since the early 20th century.

During the financial crisis, base money increased by $0.8 trillion in a couple of months. Form there, the amount of base money expanded much further, increasing more than fourfold by the summer of 2014.

But what seemed like a staggering increase in base money in November 2008 looks relatively small in comparison to the increase in base money that we would go on to see in 2020. From the end of February to the end of December 2020, the base money increased $1.8 trillion dollars. That is equivalent to all the base money that existed in the history of the U.S. as of September 2009.

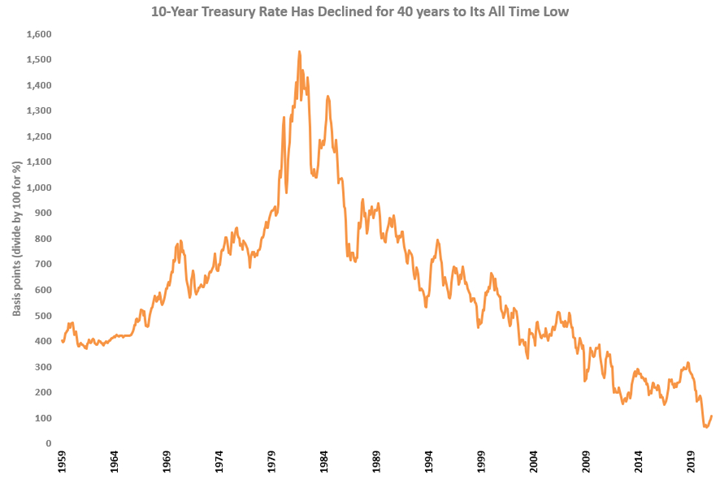

Where did this money go? It has gone into various assets and raised their prices. But particularly significant to this argument, it went into the bond market, driving up the prices of bonds, which led to a fall interest rates. Currently, the 10-year Treasury rate is about 1.5%, which is easily an all-time low. This means money is cheap, historically so.

Now, I believe the expansion in money is to some extent hitting manufacturing.

For most of the last two decades, manufacturing has generally been ignored by Wall Street and investors. Manufacturers across many sectors were shifting to offshore manufacturing capabilities rather than investing in more productive capacity at home. The pendulum is swinging the other way now, with supply chains shifting and being disrupted. The importance of this has become a focus of not just OEMs, but also investors. Currently, manufacturing is one of the stronger sectors of the economy, maybe the strongest. Consumer durable goods spending in the U.S. is at its highest percent of total consumer spending ever.

Because manufacturing has generally been ignored and is doing relatively well, there is profit opportunity for investors, including at small and medium size machine shops. There are more than 20,000 machine shops in the U.S., and many of them have worked to transform themselves into more modern and effective manufacturing service providers, in part by leaning into some of the factors Peter Zelinski mentions at the link above.

Related Content

Understanding Errors In Hand-Held Measuring Instruments

Different instruments (and different operators) are prone to different errors.

Read MoreKey CNC Concept No. 1—The Fundamentals Of Computer Numerical Control

Though the thrust of this presentation is to teach you CNC usage, it helps to understand why these sophisticated machines are so important. Here are but a few of the more important benefits offered by CNC equipment.

Read MoreChoosing The Right Grinding Wheel

Understanding grinding wheel fundamentals will help you choose the right wheel for the job.

Read MoreHow to Reduce Cycle Times by 70% and More on Your Existing CNCs and Dramatically Improve Tool Life Too

By employing advanced high efficiency milling techniques for the entire machining routine, SolidCAM’s iMachining technology can drastically reduce cycle times while vastly improving tool life compared to traditional milling.

Read MoreRead Next

5 Reasons Why Machine Shop Ownership Is Changing

Mergers, acquisitions and other ownership changes are an effect of Boomer-age shop owners retiring, but only in part. Also important: The way we think about machining has changed.

Read More3 Mistakes That Cause CNC Programs to Fail

Despite enhancements to manufacturing technology, there are still issues today that can cause programs to fail. These failures can cause lost time, scrapped parts, damaged machines and even injured operators.

Read MoreThe Cut Scene: The Finer Details of Large-Format Machining

Small details and features can have an outsized impact on large parts, such as Barbco’s collapsible utility drill head.

Read More.png;maxWidth=970;quality=90)

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)