Can Sharing CNC Data Lift the Machining Industry?

Masses of anonymous metrics arrive ahead of even the leading economic indicators and help machine shops benchmark performance.

Share

I’m writing this column a week after attending a March 25 webinar about the effects of the coronavirus on the manufacturing industry. Although the presented data will be out of date by the time this is published, the pandemic was not the point. The broader takeaway was the potentially vast power of widely shared machine utilization data for improving business planning and benchmarking, whatever the economic situation.

The power of this dataset is that it is available in real time, in this case through webinar host MachineMetrics’ multi-tenant cloud platform. Taken from thousands of machines in every sector of the industry, the anonymous, aggregated data often reveals trends and insights prior to leading economic indicators such as industrial production and the Purchasing Managers’ Index (PMI), says company co-founder Bill Bither.

He went on to show graphs of utilization and downtime data illustrating steep declines in the automotive industry after the “Big 3” automakers shut down only days before. “We have the real-time element — the pulse of manufacturing,” he said.

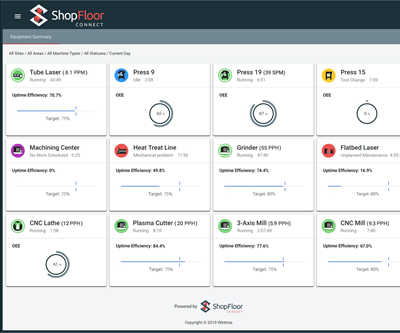

A snapshot of utilization data on March 25, by which point the automotive sector had declined steeply.

Quarantined at home, my first reaction was that anyone could see things are changing, and that the pandemic’s grip on the economy has only begun to tighten. However, the potential in this data was just as obvious, and other insights are already coming into focus. For instance, during a phone conversation a week after the webinar (which was the first in a planned series of presentations on the impact of the virus), Mr. Bither speculated that an uptick in automotive utilization might be a result of manufacturers retooling for medical supplies. Pandemics aside, less obvious correlations and trends that might guide manufacturers’ planning are likely to show up here first.

Perhaps more importantly, revealing broad economic trends is only a beneficial byproduct of the company’s data collection. “The real benefit for the machine shop is how this data correlates to their own operations,” Mr. Bither said.

For instance, MachineMetrics’ regular reports reveal that having a “case of the Mondays” is a very real phenomenon. The aggregate data show that, in general, machine utilization tends to be lowest on that day before peaking by Wednesday and dropping again into the weekend. This can also be narrowed to hours of the day, and extrapolated to the entire calendar year. In one case, proving a gut instinct with real data led one MachineMetrics customer to eliminate Columbus day and extend the Christmas holiday instead.

Finding surprises in the data is even more valuable, Mr. Bither said, pointing out that shops’ actual average machine utilization, which is generally around 25%, pales in comparison to the 60% or greater that most users assume prior to implementing company’s machine monitoring system. Where does a shop stand in relation to other businesses in machine utilization as a whole, or, more specifically, time lost to changeovers? Which machine types experience more downtime on average, and why is that? Are shops in the Northeast experiencing higher utilization rates than those in other regions?

MachineMetrics aims to make such insights available at any time to everyone via regular “State of the Industry” reports published online, Mr. Bither said. These reports would not be possible without the system’s users, all of which must opt in. Beyond being willing to share data, they are obviously comfortable with machine monitoring generally, as well as cloud computing and, if that is any indication, other tools of data-driven manufacturing. Data democratization, and the benefits all stand to share, begins with individual shops understanding that in many ways, they’re all in it together.

Related Content

Aerospace Shop Thrives with Five-Axis, AI and a New ERP

Within three years, MSP Manufacturing has grown from only having three-axis mills to being five-axis capable with cobots, AI-powered programming and an overhauled ERP. What kind of benefits do these capabilities bring? Find out in our coverage of MSP Manufacturing.

Read MoreTaking Machine Monitoring from Data to Action

What will define the next stage of machine monitoring software? MachineMetrics’ Rutherford Wilson believes the answer will look something like a manufacturing execution system.

Read MorePrecision Shop Adopts Machine Monitoring, Boosts Revenue

Adopting machine monitoring helped LeClaire Manufacturing boost its vertical CNC utilization rates 38 percentage points and gain millions in revenue.

Read MoreProtecting Your Automation Investments

Shops need to look at their people, processes and technology to get the most of out their automation systems.

Read MoreRead Next

3 Principles for Growing with Machine Monitoring Data

Following a few basic principles can help shops get a return on their machine monitoring systems without losing faith first.

Read MoreMachine Monitoring Enhances Human Resource Functions

Decisions about manufacturing processes are not the only business factors that can be improved by the insights derived from data collected by a machine-monitoring system. For this shop, using this information to strengthen and fine-tune its employee incentive program is a significant benefit, among many others.

Read MoreMachine Monitoring Provides an Objective Lens

Automatic, real-time shopfloor data collection tempers the bias that blinds manufacturers to the real reasons for downtime.

Read More