Data Demystify CNC Machine Shop Sales, Marketing

Benchmarking surveys show how perception departs from reality when Top Shops evaluate the growth potential of advertising, social media and other tools.

Share

The best manufacturers are not necessarily the best role models for effective sales and marketing. In fact, a recent reading of data from Modern Machine Shop’s Top Shops benchmarking program reveals a disconnect between the strategies that impact company performance and the methods employed by even the most successful machining businesses to sell themselves.

Top Shops data reveal participation in trade shows and other industry events (such as IMTS, shown here) to be strongly correlated with a shop’s number of active customers. More customers help scale revenue to the size of a company in order to sustain growth.

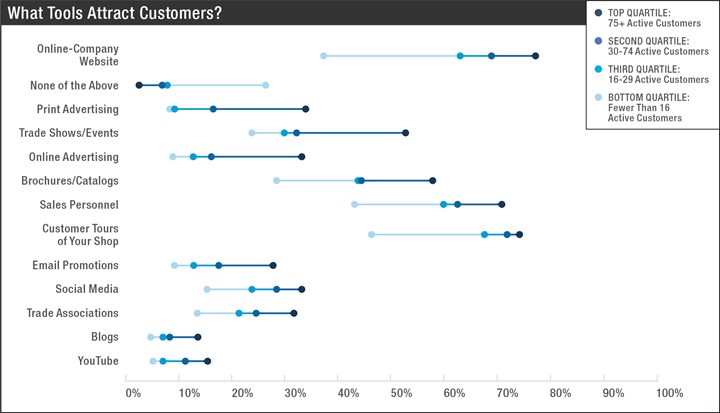

The data also reveal a potential reason for the disconnect: Not all sales are created equal. More sources of sales — a greater number of active customers — improves the likelihood that additional sales revenue scales with the size of the company. In contrast, too much focus on winning (and/or keeping) work from a smaller group of customers can eventually lead a business to plateau. “Turning $1 million in sales to $2 million is much easier than turning $10 million to $20 million, even with the same growth rate,” explains Steve Kline of Gardner Intelligence, a division of MMS publisher Gardner Business Media. “Essentially, it’s easier for smaller companies to grow faster.”

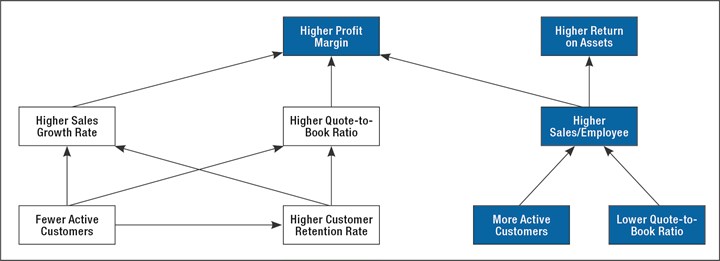

According to our benchmarking data, machine shops with more active customers tend to have higher sales per employee. Sales per employee is a critical measure because it correlates strongly with not only profit margin, but also overall return on assets. In other words, companies with higher sales per employee are likely bringing in enough revenue to cover all their investments.

However, the tools that are most strongly correlated with a greater number of active customers (and greater sales per employee) are often underappreciated, even among top performers. For example, machine shops see little value in advertising. Yet, print and online advertising were outclassed only by maintaining a quality website in the strength of their correlation with having more customers.

Other disconnects are less extreme. Nonetheless, Top Shops data indicate that many CNC machine shops interested in growth would be well-served by re-evaluating their goals, and by extension, their mix of marketing tools and strategies.

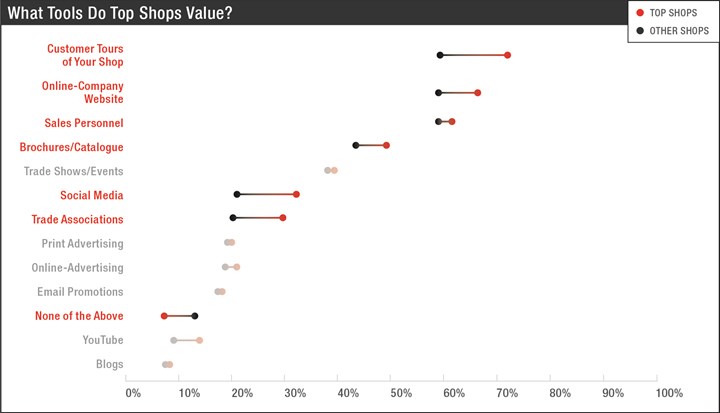

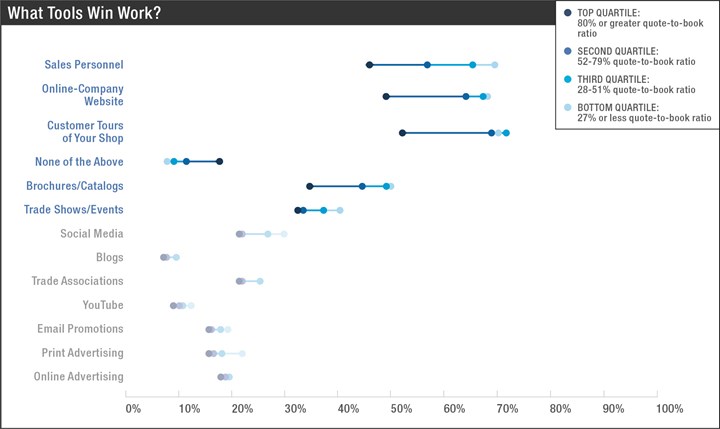

The sales/marketing tools here are listed in the order of what survey takers deem to be most effective. However, only the tools in red text have a statistically significant correlation with finishing in the top quartile versus the bottom quartile of Top Shops scores. If the tools were listed by correlation with score, social media, none of the above (an inverse correlation) and trade associations would make the Top 5, and brochures would be No. 6.

Is Your Marketing Data-Driven?

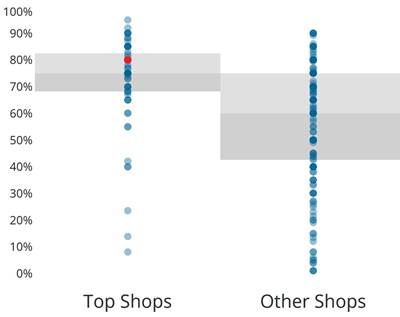

One thing Top Shops get right is investing time and energy into sales and marketing.

As defined by our benchmarking program, “Top Shops” are those that score in the top 20 percent of all survey-takers based on an aggregate of weighted metrics. This group is more likely to value every specific tool and strategy listed in the survey. In fact, shops indicating that they do not consider any of the sales and marketing tools to be “effective” are unlikely to be Top Shops. Most of those that score high enough to be Top Shops despite considering all tools to be ineffective break into only the bottom quartile of that elite group.

Clearly, sales and marketing work. However, why Top Shops do what they do is often murky, perhaps even to the shops themselves.

Social media is a good example. Two-thirds of Top Shops use some variety of social media. They are more likely to use more than one platform, too. Claiming social media is an “effective” sales and marketing tools tool is the second-best predictor of a high Top Shops score (right behind claiming customer tours). The social media data also mirror the data on all tools in that shops that do not use it are more likely to score in the bottom quartile of survey-takers.

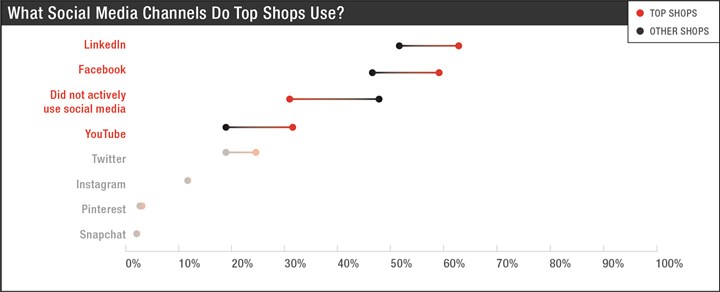

Nearly a third of Top Shops do not use social media. Among the two thirds that do, these are the specific platforms they deem most effective. Red text indicates tools with a statistically significant correlation with finishing in the top quartile versus the bottom quartile of Top Shops scores

Using social media appears to be a good idea. But why? Our data show little impact on company performance metrics. What’s more, a full third of Top Shops earned that designation without using social media (despite the correlation with a low score). Even among the majority of Top Shops that use social media, only one third say that it is an effective sales and marketing tool. In short, many Top Shops use social media even though they believe it is ineffective.

Are Top Shop leaders adopting social media merely because they think that is what “good” companies do? Have only a small percentage of Top Shops learned to use social media effectively, while the rest founder along behind? Or, are these tools simply ineffective for marketing machine shops? Whatever the answer, our data show that adding customers drives growth, and that every other sales and marketing tool is more strongly correlated with having more customers than social media.

Having more customers creates a more robust ongoing revenue stream. – Steve Kline, Gardner Intelligence

The same dynamic is at work beyond social media. Print and online advertising are among the tools most strongly correlated with having more customers, but land at the bottom of the list of tools that survey-takers consider to be most effective. Perhaps machine shops are not advertising due to lack of viable outlets, or perhaps they are simply not good advertisers. Regardless, many of these shops might consider attending more trade shows and events in place of, say, producing more brochures and catalogs, a strategy that survey-takers prioritized higher. The point is that correlation is not causation. Deeper analysis determines what really works, and what really works is not always intuitive.

This chart ranks sales and marketing tools by the strength of their correlation with the number of active customers. The percentages indicate how many surveyed shops with a given number range of active customers believe a given tool is effective. This data show that print advertising, trade show events and online advertising are all more statistically correlated with having more customers than customer tours, sales personnel and brochures/catalogues, even though shops rank the latter three as more effective.

Right Strategies, Wrong Goals

Perception matches better with reality at the top of the list of sales and marketing tools that Top Shops consider to be most effective. For example, customer tours and sales personnel (both in the top 3) are both strongly correlated with quote-to-book ratio. Quote-to-book ratio correlates strongly with profit margin. This makes sense, because a high quote-to-book ratio often indicates that a shop is bidding on (and winning) the right kind of work. Shops with a high quote-to-book ratio also tend to have a high customer retention rate, and customer retention rate correlates strongly with sales growth.

Although there are multiple paths a shop might take toward profitability, sales per employee is correlated with both profit margin and return on assets.

However, a shop that reads too much into these intuitive correlations could wind up employing the right strategies to achieve the wrong goals. For example, if the shop wins more quotes than it loses, is that really a win? Or is the shop just too comfortable? Is the shop already pricing too low, or making too many concessions to keep existing customers? Is the shop missing opportunities to interact with potential new customers, to better understand its place in the market, and to get better at judging contract terms and otherwise navigating the quoting process? In short, a low quote-to-book ratio is not necessarily an indicator of wasted time. Rather, it could be a marker of a hungry shop that is eager (and perhaps more likely) to expand.

Lower quote-to-book ratios are also correlated with higher sales per employee. As we have established, sales per employee is strongly correlated with both profit margin and return on assets, and scaling growth to the size of a company requires both. Meanwhile, shops with higher quote-to-book ratios tend to have fewer active customers, and those with fewer active customers tend to have lower sales per employee.

Personal interaction is critical to winning the right (although perhaps fewer) jobs. This chart ranks sales and marketing tools by the strength of their correlation with quote-to-book ratio. The percentages indicate how many surveyed shops with high, low, and mid-level quote-to-book ratios believe a given tool is effective.

Our hypothetical shop, with its loyal, frequently touring customers, effective salespeople and high quote-to-book ratio, might be a profitable business. It might even score high enough on our survey be considered a Top Shop. Nonetheless, it will be unlikely to grow until it follows the path illuminated by the data: Make more quotes. Actively seek new business. Even if this means losing many bids (and perhaps a lot of time), expanding the pool of potential customers will drive growth. Eventually, keeping every customer will no longer be essential, and the shop can bid more competitively.

As Kline explains it, “Having more customers creates a more robust ongoing revenue stream. In other words, each customer tends to count for a smaller percent of revenue. So, losing one customer doesn’t hurt revenue as much, and the one lost customer is easier to replace. Having fewer customers makes the ongoing revenue stream more brittle or fragile. Losing one customer makes a bigger dent in revenue.”

Customer Attraction to Customer Retention

The tools and strategies likely to increase active customers have something in common: They are all impersonal. This makes intuitive sense. After all, our hypothetical shop cannot build relationships unless it finds customers first (perhaps by advertising to attract prospects to its well-maintained website). With prospects to court, more personal tools — the ones that Top Shops survey-takers tend to favor most — become more valuable.

Tools at the top of this list tend to involve the kind of face-to-face interaction that helps build trust and retain customers. Personal follow-up with new and potential customers is also likely to provide the kind of education that helps better evaluate the competitiveness of new work and the terms of new contracts. For our hypothetical shop, this might result in a growing quote-to-book ratio, even as sales per employee remains high enough to sustain continued expansion.

Related Content

Creating a Learning Culture at JD Machine

JD Machine, 2024’s Top Shops Honoree in Human Resources, embodies its “Education for Life” core value with a robust apprenticeship program and significant continuous improvement efforts.

Read MoreHow to Succeed as a Small Swiss Shop: Top Shops 2025

Can small shops succeed with advanced machine tools and software? If so, how do they do it? Read on to learn the strategies that have helped Midway Swiss Turn, our 2025 Top Shops Honoree in Shopfloor Practices, thrive.

Read MoreInside the Top Shops Program: How Benchmarking Identifies Industry Leaders

Discrete parts manufacturing is defined by complexity and tight margins. The 2025 Top Shops honorees show how leading shops turn those pressures into strengths, using technology, culture and strategy to compete. Join them in Charlotte, North Carolina, this November to see what the top 20% are doing differently.

Read More2024 Top Shops Honorees Announced

Modern Machine Shop Recognizes Excellence in Manufacturing with Annual Award

Read MoreRead Next

Benchmarking Becomes a Call to Action

A means of measuring performance evolves into a tool for catalyzing change as Modern Machine Shop’s Top Shops program matures.

Read MoreFive Traits Define Top Performers in Five-Axis Machining

Benchmarking data reveal how elite manufacturers make the most of more axes of motion.

Read MoreOEM Tour Video: Lean Manufacturing for Measurement and Metrology

How can a facility that requires manual work for some long-standing parts be made more efficient? Join us as we look inside The L. S. Starrett Company’s headquarters in Athol, Massachusetts, and see how this long-established OEM is updating its processes.

Read More