The Machine Tool Industry Is Booming Globally

U.S. machine tool purchases rose in 2017, as shown by the 2017 World Machine Tool Survey. A global boom now makes it hard for U.S. shops to get new machines.

Share

The U.S. metalworking industry is red-hot. The Gardner Business Index (GBI): Metalworking averaged nearly 56 in 2017, which was easily the best year since Gardner Intelligence started the Index almost seven years ago. The Metalworking Index continued to increase in the beginning of 2018, hitting an all-time high of 61.3 in February.

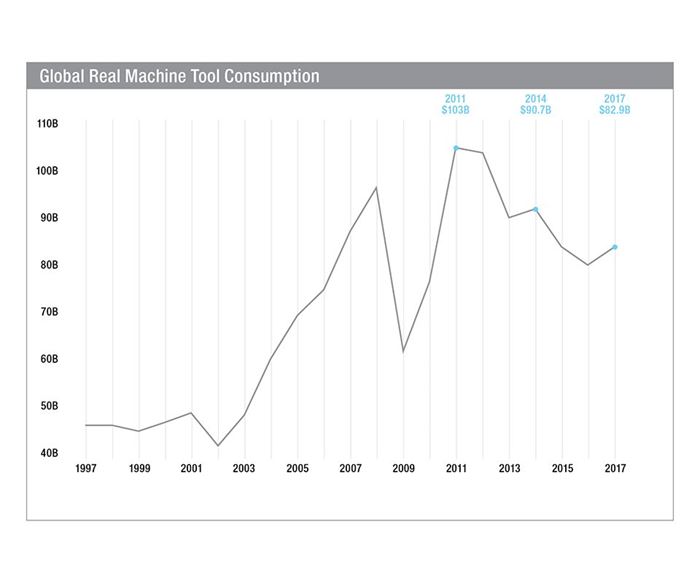

The strong performance of metalworking facilities throughout 2017 resulted in a significant increase in machine tool consumption, as reflected by data from Gardner Intelligence’s latest World Machine Tool Survey. Machine tool consumption in the United States totaled $8.142 billion in 2017, an increase of 6.8 percent from 2016. This increase represented the fastest growth rate since 2011, and the second fastest since 2007.

While a 6.8-percent increase is commendable looking at consumption in the last 10 years, it is relatively low compared to, let’s say, a 60-year history of U.S. machine tool consumption. So, why do I say that the machine tool industry is booming?

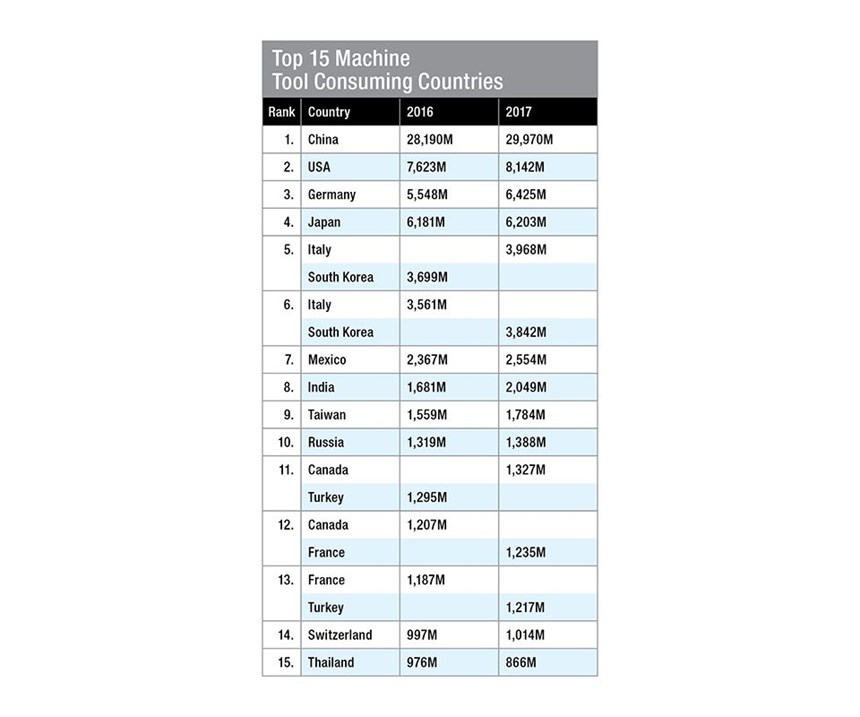

In 2017, 12 of the top 15 countries that consume machine tools increased their consumption from the previous year. This occurrence is rather unusual: The last time this occurred was 2011. That year, all of the top 15 countries that consume machine tools increased consumption—the only time that has ever happened. However, the industry was then in the midst of a rapid recovery from the Great Recession of 2007. Since 1980, only six years saw more than 12 of the top 15 increase consumption. Before 1980, no single year showed that level of growth.

At the moment, I do not think the strength of the top 15 consuming countries will decline in 2018. We can make a rough estimate of machine tool consumption in a country by analyzing the trends in its money supply, industrial production and capacity utilization. This analysis indicates that it is quite possible for 13 of the top 15 countries that consume machine tools to increase consumption in 2018.

Indeed, the machine tool industry is booming, but not based solely on United States doing well. Rather, it is because almost all major manufacturing countries around the world are doing well.

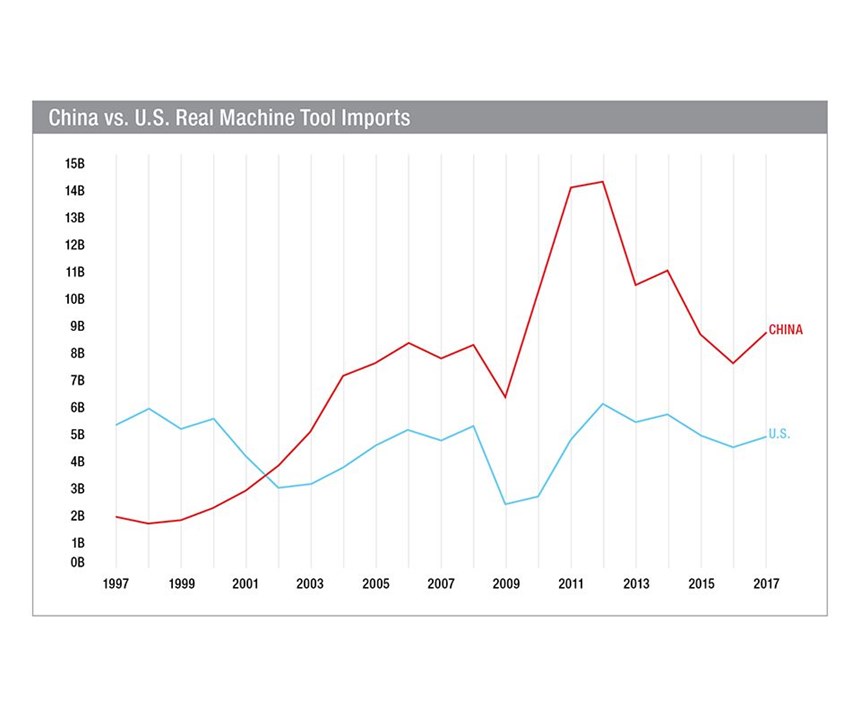

Perhaps most importantly, China raised its 2017 machine tool consumption by $1.780 billion to $29.970 billion, an increase of 6.3 percent. This increase in Chinese consumption made China the 10th largest machine tool consuming country. Although China increased its domestic production of machine tools and consumed more of that output than in the past, it increased its imports significantly in 2017 as well. Chinese imports rose to $1.147 billion, an increase of 15 percent from the previous year.

Impact on U.S. Buyers

The surge in Chinese consumption and imports has made it more difficult for U.S. metalworking facilities to get their hands on new machines. Even though the United States increased its imports by nearly 10 percent in 2017, it did not increase them as much as China did. This means that there were relatively fewer machine tools available for export to the United States

According to the International Trade Centre, the top five machine tool producers (excluding China and the United States) increased their exports to China by $192 million, while decreasing their exports to the United States by $126 million. The dramatic difference in the export numbers to China and the United States is attributable primarily to builders in Japan and Taiwan.

Japan is noted for its high-end machine tools, which usually top the selection lists of U.S. machine tool consumers. More of these sought-after machines went to China rather than to the United States in 2017. When these high-end machine tools are in short supply, U.S. machine tool consumers must move down their priority list. At these times, they typically look to countries such as Taiwan as a source for this technology. Although Taiwan did increase its exports to the United States, it did so at a lesser-than-expected extent in favor of increasing its exports to China instead. This shift makes sense as the two countries are much closer geographically and share the same roots in language and culture. As a result, fewer machines from Taiwan were available to U.S. consumers.

The net effect of these facts about consumption and import/export trends is that machine tools have been increasingly difficult to acquire in this country. However, there are other significant factors influencing the global supply of machine tools.

For example, global machine tool production increased rapidly in 2017. It went up by almost 7 percent, the highest rise in one year since 2011. This jump strained the supply chains of machine tool builders, thus creating a scarcity of many critical component parts such as ballscrews, guideways and base castings. Therefore, even though demand now calls for an increase in production, machine tool builders simply cannot comply because they cannot get the needed parts to make the machines.

Furthermore, electronics giants such as Samsung are dramatically increasing their capital equipment expenditures. A Wall Street Journal article from January 9 called “Tech’s Enormous Scale: Samsung Now Outspends Exxon and Shell Combined,” reported that “Samsung Electronics Co. spent more money on capital expenditures last year than any other publicly traded company.” The $44 billion total tops the combined capital equipment spending of the world’s largest energy companies. According to the article, Samsung plans to spend an additional $110 billion over the next three years. Much of this investment will go toward the production of memory chips for all those devices we carry in our pockets and wear on our wrists.

So, how does this contribute to the difficulty in getting a new machine tool?

Samsung, and other companies like it, are investing heavily in equipment used to manufacture semiconductors. Most of these machines use the same guideways and other components as machine tools. This massive demand by technology companies soaks up critical parts for machine tools, further inhibiting machine tool builders from responding to the recent surge in demand for their products.

How to Respond

This development leaves U.S. metalcutting facilities struggling to acquire new machinery at a rate that is likely not fast enough to meet current manufacturing needs. So what can these companies do in the meantime to increase production and capacity?

Here are some questions that might give possible answers:

- What automation equipment—robots, rotary tables, bar feeders, pallet systems, etc.—can be used to increase productivity on existing or available machines?

- What new workholding equipment, such as pedestal fixtures or indexers, can increase the efficiency of part setups?

- What new cutting tools or CAM programming features can improve metal removal rates?

- How can a machine monitoring system or new shop control software help find and overcome hidden inefficiencies?

- What changes can boost lights-out operations? Which are the real moneymakers?

As you examine such questions, continue to go about your usual machine tool selection process, but be prepared to wait a little longer, pay a little more or go further down your selection list once you make a decision. While you are at it, start thinking about your next machine tool purchase. At least in the United States, the red-hot machine tool market should cool a bit in 2019. That may provide the ideal respite for implementing new technology.

Read Next

OEM Tour Video: Lean Manufacturing for Measurement and Metrology

How can a facility that requires manual work for some long-standing parts be made more efficient? Join us as we look inside The L. S. Starrett Company’s headquarters in Athol, Massachusetts, and see how this long-established OEM is updating its processes.

Read More

.JPG;width=70;height=70;mode=crop)