World Machine Tool Report 2024: Contractions in Domestic and Global Markets

All four categories of the World Machine Tool Report — production, imports, exports and consumption — fell globally and domestically in 2024. But it’s not all bad news.

Share

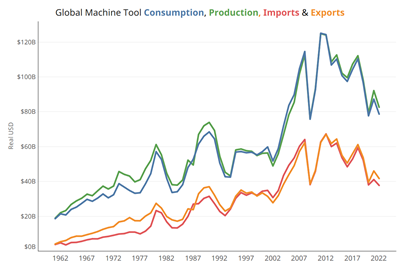

The global machine tool market shrunk in 2024 across all metrics, according to the 2024 World Machine Tool Report. Overall production in the 54 countries measured in this year’s report shrank from $88.3 billion to $83.4 billion, while consumption declined slightly further from $85.1 billion to $80.0 billion.

The U.S. saw declines across all four metrics measured in the 2024 World Machine Tool Report. The decline in machine tool consumption was largely driven by decreases in production and imports, with exports seeing a much milder drop. All charts are adjusted for inflation, and are courtesy of Gardner Intelligence.

But this picture is a little more complicated than it seems, according Gardner Intelligence Senior Market Research Analyst Mike Shirk “Seven of the top ten machine tool consuming countries, accounting for over 65% of total global consumption, saw decreases in 2024,” Shirk says. “However, 80% of the remaining countries recorded increases. This seems to indicate a shift in diversification of advanced manufacturing as more countries look to increase their durable goods manufacturing capabilities, both for domestic benefit and to compete in the international market.”

The Domestic Picture

The U.S., like many of the countries that typically occupy the survey’s top 10 lists, shrunk across the four key metrics of the report. Across the eight machine tool categories measured, machine tool production decreased from $8.3 billion in 2023 to $7.1 in 2024, exports fell from $1.8 billion to $1.5 billion, imports declined from $6.7 billion to $6.2 billion and overall machine tool consumption shrunk from $13.2 billion to $11.8 billion. One silver lining to this data is that none of these decreases in dollar amount led to changes in the U.S.’ rankings within each top 10 list. The country is still fourth in production (in dollar amount), eighth in exports, first in imports and second in consumption.

Digging further into the data for the U.S., imports for machining were down in four of the top eight machine tool categories: The grinding, honing and deburring equipment category saw a 0.5% decrease in imports from 2023; machining centers saw a 10.9% decrease; lathes a 14.9% decrease; and EDM, laser and waterjet machines a 22.2% decrease. However, broaching, gearcutting, and sawing equipment saw a 5.4% increase; while the forging, stamping, bending and shearing machines and presses category saw a 5.6% increase in imports; boring, drilling, milling, and threading equipment saw a 12.0% increase; and draw benches, thread rolling equipment and wire working machines saw a 31.9% increase.

In contrast, seven of the eight categories showed drops in exports, with only one rising. Lathes saw an 11.4% drop in exports; broaching, gearcutting and sawing equipment a 15.4% drop; forging, stamping, benching and shearing machines and presses a 17.4% decrease; draw benches, thread rolling equipment and wire working machines a 19.1% drop; grinding, honing and deburring equipment a 20.6% decrease; boring, drilling, milling and threading equipment a 22.5% drop; and EDM, laser and waterjet equipment a 27.5% decrease. The last machine tool category, machining centers, was the only one to see growth, with an 18.6% increase in exports.

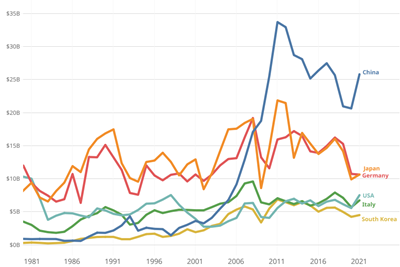

Production and Consumption

The U.S.’ lack of ranking changes holds true to overall trends in the list of top 10 machine tool producing countries. China still leads the list at $27.3 billion, followed by Germany ($10.9 billion), Japan ($7.9 billion), the U.S. ($7.1 billion), Italy ($6.6 billion), South Korea ($4.5 billion), Taiwan ($2.9 billion), Switzerland ($2.7 billion), India ($1.7 billion) and Spain ($1.4 billion). The countries on the list are the same ones as 2023, and their order remains the same from 2023 to 2024. That said, of these countries, nine saw decreases in the dollar amount of their machine tool production, with Japan seeing the steepest drop in both absolute dollars and percentage. The only country that did not see a decrease in production is India, which saw an 8.5% increase.

Machine tool consumption, on the other hand, did see some changes from 2023. China ($24.6 billion), the U.S. ($11.8 billion) and Germany ($5.3 billion) continue to be the top three consumers of machine tools, but the next three are different from 2023. India ($3.6 billion) has gone from sixth to fourth, with Italy ($3.4 billion) and Japan ($2.9 billion) each moving down a slot to fifth and sixth, respectively. South Korea ($2.9 billion) and Mexico ($2.6 billion) remain in the same spots on the list as last year, in seventh and eighth. Further changes come at the bottom of the top 10, with Turkey ($1.9 billion) rising from 10th to ninth, and Canada ($1.6 B) gaining ground from 12th to 10th. India, Mexico and Canada saw increases in their total machine tool consumption, while the other nations on the list saw theirs shrink.

All global metrics tracked by the 2024 World Machine Tool Report fell. The Gardner Intelligence team calculates consumption by adding together production and imports, then subtracting exports.

Imports and Exports

As with production and consumption, the global numbers for imports and exports have decreased. Imports fell from $43.2 billion to $41.8 billion, while exports fell from $46.3 billion to $45.2 billion.

The top two global importers of machine tools remained the same, with the U.S. ($6.2 billion) leading and China ($5.5 billion) in second. Mexico ($2.6 billion) and Germany ($2.4 billion) have swapped spots for third and fourth, while India ($2.1 billion) has climbed to fifth place, Turkey ($1.7 billion) to sixth and Vietnam ($1.3 billion) to seventh. Italy ($1.2 billion) is down to eighth, with Russia ($1.2 billion) falling to ninth. France ($1.1 billion) remained steady in 10th. Of these, Mexico, India, Vietnam and France saw growth in imports, while the other nations saw decreases in their total dollar amount of machine tool imports.

In exports, China and Germany traded places for first and second, with China exporting $8.2 billion worth of machine tools and Germany $8.0 billion. Japan ($5.7 billion), Italy ($4.5 billion) and South Korea ($2.5 billion) remain in third, fourth and fifth, respectively. Switzerland ($2.3 billion) and Taiwan ($2.2 billion) have also traded places, with Switzerland moving to sixth and Taiwan to seventh. Rounding out the top 10 are the U.S. ($1.5 billion), Spain ($1.2 billion) and Belgium ($1.0 billion), which have not changed order between eighth, ninth, and 10th. Chinese, Italian and Belgian machine tool exports grew from 2023 to 2024, with the other countries in the top 10 seeing declines.

The Big Picture

Internationally, some notable trends emerge when looking into the broader data. India and Brazil both saw increased machine tool production and imports year-over-year with lower machine tool exports, suggesting that both nations are focusing on modernizing and expanding their industrial infrastructure. Other nations with historically high machine tool production are seeing increasing foreign demand, even with lower domestic demand: While China, Germany and Italy all saw overall machine tool production and imports decrease, China and Italy saw modest increases in their machine tool exports, and Germany’s decrease in exports was milder than its decreases in production and imports.

In terms of markets, many countries in Southeast Asia saw significant machine tool imports, with higher imports in Vietnam, Thailand, Malaysia, Indonesia and Singapore. While Thailand and Vietnam experienced decreases in machine tool production and exports, Malaysia, Indonesia and Singapore all saw increases. All five countries saw increases in machine tool consumption of over $100 million compared to 2023 (Thailand saw the highest increase, at over $300 million year-over-year), suggesting that multiple nations in this region have serious ambitions for domestic metalworking.

In Europe, traditional high-production and import markets like Germany, Italy, Switzerland, Spain, and Russia saw drops in both metrics compared to 2023, but this was not the case across the continent. Austria, Bulgaria, Denmark, Finland, France, Greece, the UK, Norway, Poland, Portugal, Romania, Slovenia, Sweden and Ukraine all increased both their machine tool production and imports, with several other nations seeing increases in one or the other. Of particular note, Finland saw a 201.4% increase in machine tool production, with Portugal showing 175.7% growth and Greece a 111.1% growth in the same. Turkey saw a significant increases in domestic machine tool production and exports, but lower imports led to a slight decrease in overall consumption.

What Goes Into the Data?

This data comes from the 57th annual World Machine Tool Survey, which is conducted by Gardner Intelligence, the business intelligence division of Modern Machine Shop’s parent company. This survey ranks the world’s countries in machine tool production, consumption, imports and exports, taking reported and estimated machine tool economic data and adjusting for exchange rates and inflation to enable year-to-year (and country-to-country) comparisons in real U.S. dollars.

Criteria for inclusion in the survey are that the country has imported at least $100 million of machine tools over at least one year since 2001, and that the Gardner Intelligence team can access or reasonably estimate the country’s data. For countries that do not report import and export totals, data comes from the International Trade Centre (ITC). The ITC reports imports and exports at the machine tool category level for all countries, calculating production estimates when data is not provided. Historic data is adjusted for inflation using the U.S. Bureau of Labor Statistics’ Producer Price Index for capital equipment, which provides high-quality comparisons over time.

Imports and exports at the machine tool category level typically add up to numbers less than or equal to the totals reported. The Gardner Intelligence team says these differences usually stem from reporting the top five machine tool categories rather than all eight. In rare cases, imports and exports at the category level can also exceed the totals reported. The team believes these mismatches occur when machine tool category-level data includes parts and components that are not included in totals. These mismatches can also occur when using different data sources.

Read Next

Breaking News from 2021 World Machine Tool Survey

Move over, July GBI! Gardner Intelligence offers a special update on the World Machine Tool Survey in place of its typical Gardner Business Index column.

Read MoreWorld Machine Tool Production and Consumption Modestly Down in 2022

While global machine tool activity slid back to 2020 levels last year, overall production and consumption were still at historically healthy levels.

Read MoreMachine Tool Markets See Minor Changes, U.S. Sees Growth

While global machine tool activity in 2023 was rather unremarkable, the U.S saw growth across all metrics tracked by the survey.

Read More