Tax Magic

Turn every dollar of your investment income into tax-free income.

Share

The term “tax-free” always has a nice ring to it. The higher the income tax rate, the nicer the ring. Previously, the maximum federal income tax rate was 35 percent, and that was bad enough. At 39.6 percent, the current rate has created a flurry of activity among high-income earners to legally avoid paying it.

And there is an additional surtax on passive investment income that can bite you for another 3.8 percent. Plus, your home state may impose an additional income tax. Some, like Nevada and Florida, have no income tax, while others charge killer rates: New York at 8.82 percent, California at 9.3 percent and Hawaii at 11 percent. So, if you have a large amount of investment income, your tax burden can range from a low of 42.4 percent to as high as 53.4 percent.

That is a worthy target to make tax-free. How? Private placement life insurance (PPLI). With a PPLI, you put after-tax dollars to work in the form of an insurance premium. There are two components to a PPLI account—one is a tax-deferred investment, and the other is an insurance benefit.

Let’s review how your wealth accumulation is impacted by a taxable vs. tax-free scenario. The following example was created by Lewis Schiff, an Austin, Texas, lawyer:

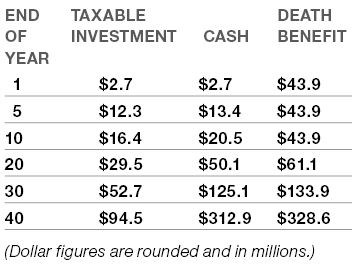

Joe, 45, owns a PPLI policy and will pay $2.5 million a year in premiums for five years. The assumed rate of return is 10 percent (net of investment/management fees), taxed as ordinary income at 40 percent (including federal and state taxes). This table illustrates the results:

So, if Joe lives to age 75, his taxable investment of $52.7 million will produce a cash value of $125 million, and the death benefit will add a tax-free bonus of almost $9 million.

The primary purpose of PPLI is to make your investment profits (whether capital gains, dividend income or interest income) tax-free. It is a form of variable universal life insurance that is offered privately rather than through a public offering. The cash value of variable life insurance is dependent on the performance of one or more investment accounts in the policy.

There are a seemingly endless number of tax magic tricks you can do with PPLI that can save you a huge amount of tax dollars.

For example, with a private placement variable annuity (PPVA) investment account, a wealthy person like Joe can put after-tax dollars to work in a tax-deferred account. As long as the assets stay within the account, Joe does not recognize any income. However, if he withdraws any money from the account, he will gain income, and it will be taxable.

The minimum size for a PPVA is $1 million, and many ultra-affluent families put $100+ million into these accounts. Because the asset commitment is much higher than that of a retail annuity, the costs are much smaller, usually less than 1 percent a year. If you are looking to defer more assets in addition to your traditional retirement accounts, a PPVA account makes sense.

Also, you can use a PPVA to endow your foundation or a public charity. Say you have $100 million of wealth. You are reasonably certain that you will never need to touch $25 million during your lifetime because you can live more than comfortably on the other $75 million. So you put $25 million in a PPVA. The money grows tax-deferred. If you need to access any of it, you can, but if you don’t, all of it will go to the charity or foundation at your death. Assuming reasonable growth of current tax and life expectancy rates, three to four times more money will go to charity using a PPVA.

When you put money into a PPLI, one of two scenarios play out. In one, you never touch the money during your lifetime, the funds grow tax-free (minus insurance charges) and the payout is income-tax-free at your death. In the other scenario, you withdraw some money from the policy during your lifetime free of tax. If you want to access more than the policy’s cost basis (i.e., the premiums paid), you can borrow at reasonable rates from the policy, also income-tax-free.

PPVAs and PPLI policies both offer a great deal of investment flexibility. You can select from a large number of hedge funds, either with the help of the insurance company or a third-party advisor whom you select.

If you have a large investment portfolio, whether CDs, municipal bonds, hedge funds, stocks, bonds, or any of the other endless parade of investment vehicles, a PPVA or PPLI is a smart wealth-multiplying strategy. Your wealth compounds at an accelerated pace, because you won’t lose one cent to income taxes.

(Thank you to Aaron Abrahms, a partner at Winged Keel Group in New York City, for his technical advice and help in writing this column.)

Read Next

OEM Tour Video: Lean Manufacturing for Measurement and Metrology

How can a facility that requires manual work for some long-standing parts be made more efficient? Join us as we look inside The L. S. Starrett Company’s headquarters in Athol, Massachusetts, and see how this long-established OEM is updating its processes.

Read More