Share

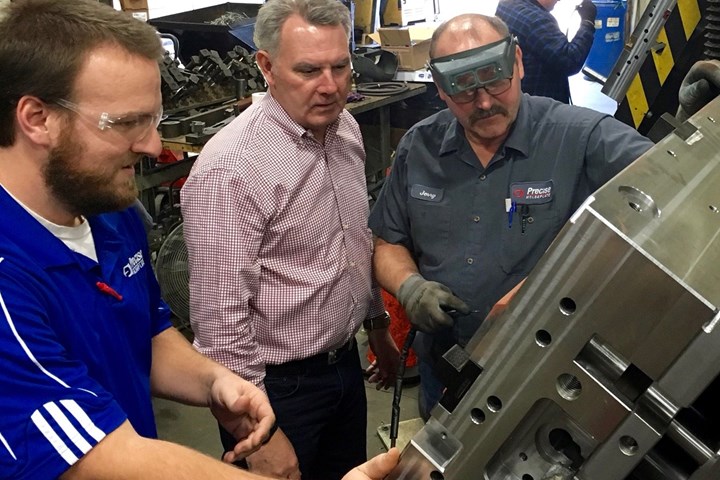

Don Dumoulin (second from left), owner and CEO of Precise Tooling Solutions in Indiana, evaluates a mold built for a customer. “The shop is humming again,” he says. Photo: Precise Tooling Solutions

How important is the 25% tariff the United States recently reinstated on China-built injection mold tooling?

For Precise Tooling Solutions, this action by the federal government could not be more meaningful. Order activity is already making it clear that this will be a good year for the shop, whereas 2019 was not. By the middle of January 2020 — that is, just three weeks into this year — this Columbus, Indiana, mold builder with a staff of 40 had already booked more molds than it did for the entirety of 2019. Employees who might have grown accustomed to 40-hour weeks will now be called upon to work significant overtime. I spoke to owner and CEO Don Dumoulin about the change. How much of the upswing does he attribute to the tariff?

“All of it,” he says. The tariff went into effect during the final days of 2019. Since then, the shop has been hearing from mold buyers who had never been customers before — injection molders that, until that point, had been committed to sourcing their tooling from China.

2018 was a strong year for the shop, too. The tariff went into effect in July of that year. It was rescinded at the end of that year, and now recently restored, as the presidential administration apparently agreed with comments filed by 150 American mold builders on behalf of this action. Precise’s experience certainly demonstrates the effectiveness of the move. “The shop is humming again,” Mr. Dumoulin says. Meanwhile, he argues the tariff was also the right move.

A tariff is arbitrary, to be sure. This is one of its problems: It is a cost set by politics and bureaucracy rather than market forces and value. However, U.S. moldmakers have long struggled against arbitrary moves opposing them. Among these is the support foreign governments (China and others) give to their domestic toolmakers. By virtue of the tariff, the U.S. is now supporting its toolmakers as well.

The artificially lower cost overseas leads to another irrational factor, he says, which is the short-term actions of mold buyers. “U.S. businesses get caught up in cost savings that hurt their interests long-term,” he says. Molders saving cost by buying from foreign sources is particularly galling to him, he explains, because the mold frequently amounts to only 3-4% of the total cost of a plastic part. However, the loss of domestic moldmaking capability — a real possibility as significant amounts of mold work shift to China — would imperil plastics manufacturing. Since a new product made of plastic is defined by the mold, the ability to invent with plastics relies on access to moldmaking, and intellectual property is literally contained in the mold. If a tariff is “protectionism” — and it is — moldmaking is a capability arguably worth protecting, at least against artificial distortions.

Is 25% a fitting number? Again, arbitrary. But in this case, Mr. Dumoulin says that figure seems just right. U.S. molds are still costlier, but where the price difference compared to China used to be huge, the tariff now leaves the price of Precise’s molds generally within about 10-15%, he says. This gap is slight enough that the desire to buy domestically can close it. To many molders, the ease of proximity and the expectation of service, quality and delivery that come from sourcing from an American mold shop justify a reasonable price premium.

“Customers have always told us, if you can get the price within 20%, we will buy American,” he says. The tariff is now proving this to be true.

Related Content

Grob Systems to Host Machining, Automation Technology Event

Grob’s event brings together 21 industry partners for informative seminars and live machining demonstrations highlighting machining strategies for optimizing the production of complex aerospace, medical and mold/die parts.

Read MoreLyndex-Nikken Collets Enable Accurate Small-Diameter Cutting

The MMC Mini-Mini collet chuck is well suited for high-speed machining applications where clearance is needed, such as die mold, aerospace and medical parts.

Read MoreHow to Achieve Unmatched Accuracy in Very Large Workpieces

Dynamic Tool Corp. purchases two bridge-style double-column CNCs to increase the cutting envelope and maintain 5-micron cutting accuracy in the long term.

Read MorePunch Custom Tooling Supports Range of Manufacturing Processes

Punch Industry designs custom tooling for injection molding, stamping and equipment manufacturing processes.

Read MoreRead Next

From Making Parts to Making Profits

New management layers bold, data-driven decision-making atop a legacy of moldmaking expertise.

Read MoreOEM Tour Video: Lean Manufacturing for Measurement and Metrology

How can a facility that requires manual work for some long-standing parts be made more efficient? Join us as we look inside The L. S. Starrett Company’s headquarters in Athol, Massachusetts, and see how this long-established OEM is updating its processes.

Read More