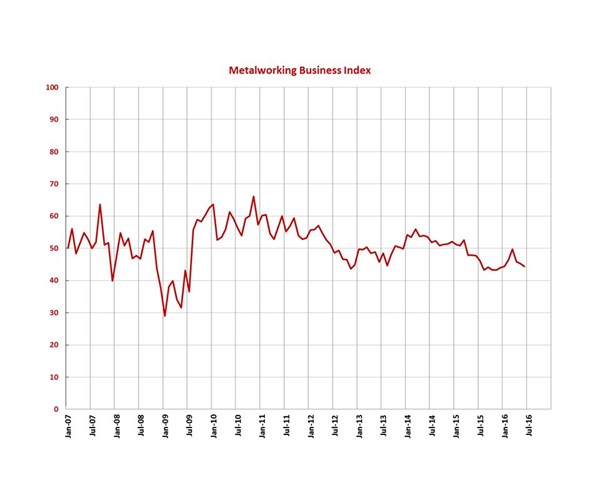

Gardner Business Index: Metalworking June 2016 – 44.4

Decelerating contraction in capital spending is a positive sign for equipment consumption.

Share

With a reading of 44.4, the Gardner Business Index showed that the metalworking industry contracted in June at its fastest rate since December 2015. The index showed a bit of a surge in the first quarter of 2016, but slowed down throughout the second quarter.

The new orders subindex has fallen off sharply since March, the one month of growth it had experienced in a year. In June, it fell to its lowest level since last October. The production subindex, which was virtually unchanged from May, is at its lowest level for the year, although it is still somewhat above its low from last year. Like new orders and production, the backlog subindex experienced a sharp spike in the first quarter of 2015, but it has since declined rather sharply, having generally contracted since April 2014. Employment also has contracted since August 2015, and, while the value of the dollar has moderated, exports also remain mired in contraction. Supplier deliveries lengthened in June at their fastest rate since June 2015.

The material prices subindex continued to increase at an accelerating rate, reaching its highest level since November 2014. Most of this surge was more likely due to the leveling off of the dollar than to a strengthening world economy. Prices received have decreased since June 2015, but the rate of decrease generally has decelerated since November. Future business expectations have declined since March, and in June were roughly at the level of the fourth quarter of 2015.

For the second month in a row, every geographic region contracted. While the Southeast had been the strongest region for a number of months, in June it ranked as the second weakest region. Although it continued to contract for the third straight month, the Northeast contracted at the slowest rate of all regions. It was followed by the North Central-West, West, North Central-East, Southeast and South Central.

While they are still well below the historical average, future capital spending plans have increased compared with one year ago for the third month in a row, therefore, the annual rate of change has contracted at a decelerating rate since February. In fact, this rate of contraction has been cut in half, which is a positive sign for capital equipment consumption.

Related Content

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

-

Metalworking Activity Stabilizes in July

July closed at 44.2, which interrupts what had been three months straight of accelerating contraction.

-

Metalworking Activity Shows Signs of Stabilizing Contraction

Metalworking activity continued to contract in what has become a rather characteristic GBI ‘dance.’

.JPG;width=70;height=70;mode=crop)

.png;maxWidth=300;quality=90)