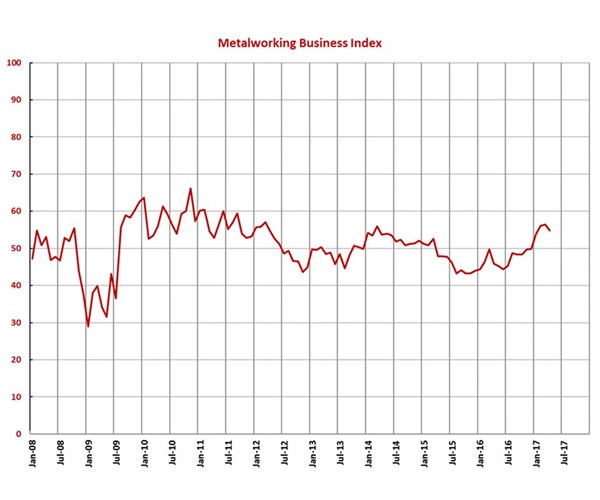

GBI Metalworking April 2017 – 54.8

Growth slows slightly, but expansion is still the greatest it has been in three years.

Share

With a reading of 54.8, the Gardner Business Index showed that the metalworking industry grew in April for the fourth consecutive month. While the rate of growth slowed slightly, the industry grew faster from January to April than in any month since May 2014.

New orders increased for the sixth straight month, although their rate of growth was the slowest of 2017. The same was true for the production index. The backlog index grew for the third month in a row, and a fast rate compared with one year earlier. This trend in the backlog index shows that capacity utilization should increase this year. Employment increased for the sixth time in seven months, but the rate of increase slowed slightly in both March and April. Exports continued to contract; their rate of contraction has remained relatively flat since November 2016. Supplier deliveries continued to lengthen at their fastest rate since April 2012.

Material prices have increased at an accelerating rate each of the last two months. The rate of increase in April was the fastest since February 2012. Prices received increased for the fifth month in a row, but the rate of increase decelerated for the second month in a row. Future business expectations remained strong, but the index fell below for the first time in 2017.

Power generation was the fastest growing industry in April, growing for the second time in three months and posting an index of 70.8. Twelve other industries recorded an index above 54.0 as well. Industrial motors/hydraulics/mechanical components grew at an accelerating rate for the fourth month in a row; aerospace has the longest streak of growth at six months; and job shops and oil/gas-field/mining machinery also grew in April. Off-road/construction machinery, military and HVAC contracted in the month.

All regions grew for the third month in a row. The North Central-West grew the fastest for the third month in a row, posting an index above 58.0 in each of those months. It was closely followed by the North Central-East. The South Central grew for the fourth month in a row, while the Southeast has had the longest stretch of growth at nine months.

Plants with more than 250 employees grew for the seventh month in a row, while facilities with 100-249 employees expanded for the fifth straight month. Companies with 50-99 employees grew for the eighth time in nine months. All three of these plant sizes recorded an index of 59.0 or greater in April. Shops with 20-49 grew for the sixth time in seven months, and shops with fewer than 20 employees expanded for fourth month in a row.

Related Content

-

Metalworking Index Shows Continued Recovery

December marks third consecutive month of metalworking improvement on the heels of increased supplier deliveries.

-

Metalworking Activity Sees Minor Drop in June

Positive results in employment trends and production are offset by supplier deliveries, among other components.

-

Metalworking Activity is on a Roll, Relatively Speaking

February closed at 47.7, up 1.4 points relative to January, marking the third straight month of slowed contraction.

.JPG;width=70;height=70;mode=crop)