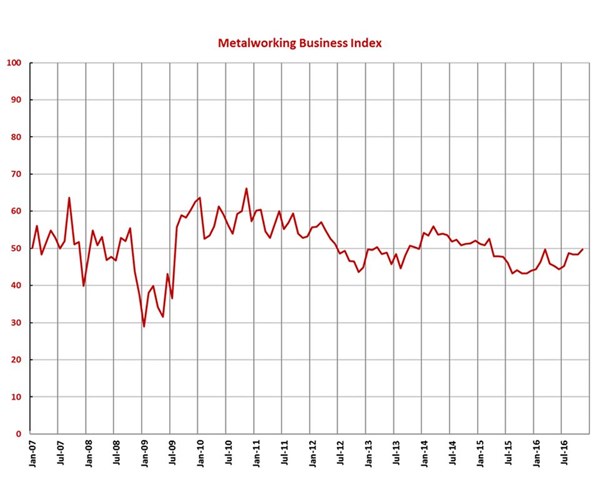

GBI: Metalworking November 2016 – 49.7

Industry shows clear improvement from where it was a year earlier.

Share

With a reading of 49.7, the Gardner Business Index showed that the metalworking industry in November was virtually unchanged from the previous month but reached its highest level since June 2015 (discounting a spike last March). The industry has clearly improved from the 43.2 reading it posted one year earlier, in November 2015.

New orders grew for just the third time since July 2015, while production increased for the third time in four months. Backlogs continued to contract, but they reached their highest level since last March and second highest level since June 2015. The trend in backlogs shows that capacity utilization should begin improving very soon. Employment was essentially flat in November after one month of minimal growth. Exports continued their long run of contraction, however, their subindex reached its highest level since May 2015 and clearly has trended up since August 2015. Supplier deliveries have lengthened since last March.

While material prices continued to increase at a significant rate in the month, the rate of increase has decelerated since last June. Prices received continued to decrease, and while they trended up from November 2015 to August 2016, they have decreased at an accelerating rate the three months since then. Future business expectations skyrocketed in November, jumping more than 12 points to 77.4, the highest level for this subindex since January 2012. Given the proximity of the surveying to the presidential election, it would seem reasonable to conclude that the metalworking industry is bullish on President-elect Donald Trump.

The aerospace industry grew in November after two months of contraction, jumping to its second highest level since the survey began in December 2011. Machinery/equipment also grew for the fourth time in five months, and the primary metals industry grew at an accelerating rate for the third month in a row. In fact, the primary metal subindex has improved dramatically from its levels in February through July. This is positive sign for the metalworking industry overall, since primary metals companies create the stock that eventually gets machined. Also, the job shops segment increased for the second time in three months, reaching its highest level since February 2015.

Four of the six geographical regions grew in November. The Southeast grew for the fourth consecutive month and posted the fastest growth for the third month in a row. It was followed by the Northeast, which grew for the first time since March; the North Central-East, which grew for the fourth month in a row; and the West, which also grew for the first time since March. The North Central-West and South Central regions have contracted for at least the last 18 months.

Plants with more than 250 employees grew for the third time in four months, and shops with 20 to 49 employees grew for the second straight month. Even though shops with fewer than 20 employees continued to contract, they recorded their highest index level since June 2015, which was their last month of growth.

Related Content

-

Metalworking Index Reaches Expansion for First Time in 2 Years

After two years of contraction, the Metalworking Index has finally turned a corner. A recovery that started in October has reached a milestone, fueled by increased production and new orders, signaling cautious optimism for the industry.

-

Metalworking Index Inches up to 49.0 in August

The GBI: Metalworking continues to hover just below expansion, but shops are cautiously optimistic.

-

Metalworking Contraction Slows Slightly in October

While still in a state of contraction, some indicators are improving in the metalworking market.

.JPG;width=70;height=70;mode=crop)