Metalworking Index Moves Closer to "Normal" for First Time During COVID-19 Crisis

Index signals decelerating contraction as new orders and production readings move higher.

Share

Metalworking Business Index: The Metalworking Index moved more than six points higher in May. Readings for new orders, production, exports, backlogs and exports along with a decline in the supplier deliveries reading were welcome news indicating a turn toward more typical business conditions.

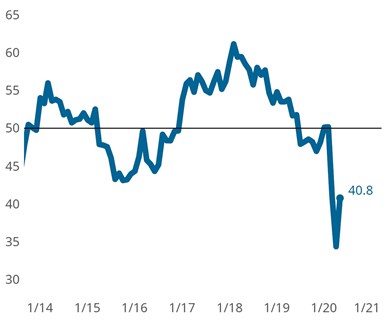

The Gardner Business Index (GBI): Metalworking registered a six-point improvement over April’s all-time low reading, ending May at 40.8. For the first time since governments curtailed normal business operations to prevent the spread of the coronavirus, all components of the index moved toward more “normal” levels. Except for supplier deliveries, all components moved higher from their prior month readings, although each remained below a reading of 50, signaling a slowing contraction. This means that while conditions deteriorated further in the most recent month, they did so at a slowing rate compared to the prior month.

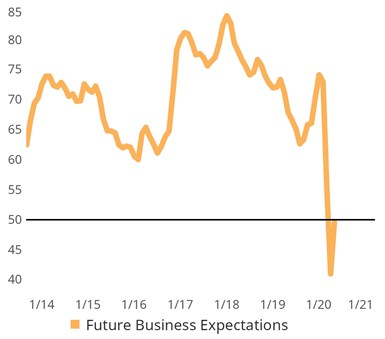

Business Sentiment Rebounds After Posting First-Ever Foray into Contractionary Territory: The improvement in the index’s components helped business sentiment move back above 50 for the first time since February. Prior to the COVID-19 crisis, the index had never registered a sub-50 reading.

The May reading for supplier deliveries also contracted by four points, implying that deliveries were not as delayed in May as they were in April. The quickening of deliveries may provide the first evidence that upstream suppliers were able to begin more normal operations after experiencing significant disruptions to operations in recent months. The resumption of deliveries may be coming at a cost to manufacturers, as a growing proportion of survey respondents reported higher price for their material inputs while also reporting for a third month an erosion of their own pricing power. The combination of these two factors implies that profit margins are under pressure.

As business activity components made their first moves toward a recovery economy in May, business sentiment within the industry also improved. Gardner’s data tracking business sentiment increased 15 points to bring the sentiment reading back above 50.

Related Content

-

Last Chance! 2025 Top Shops Benchmarking Survey Still Open Through April 30

Don’t miss out! Modern Machine Shop's Top Shops Benchmarking Survey is still open — but not for long. This is your last chance to a receive free, customized benchmarking report that includes actionable feedback across several shopfloor and business metrics.

-

Metalworking Index Inches up to 49.0 in August

The GBI: Metalworking continues to hover just below expansion, but shops are cautiously optimistic.

-

Metalworking Activity Trends Slightly Downward in April

The interruption after what had been three straight months of slowing contraction may indicate growing conservatism as interest rates and inflation fail to come down.

.jpg;width=70;height=70;mode=crop)